The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on the dangers of a French exit from the European Union. Other topics covered are the challenges of replacing the Affordable Care Act and a planned merger of the London Stock Exchange Group and the Deutsche Börse of Frankfurt.This is an online version of the print edition of the Optimal Bundle.

The Donald vs. Economics

By Peter Scharf“Last quarter it was just announced our Gross Domestic Product, a sign of strength, right? But not for us, it was below 0. Who ever heard of this? It’s never below zero.”While I try to make my writing as non-partisan as possible and eliminate all trace of bias, this piece will not follow these rules. Currently a completely unqualified authoritarian occupies the highest office in the land. He spent his whole campaign feeding nativist fears and making up statistics, or spewing “alternative facts” to dupe enough people into putting him into office. This piece will attempt to demonstrate that Donald Trump’s economic ideas are disastrous and downright idiotic. Just one week before the election more than 300 academic economists, including 8 Nobel Prize Winners, signed an open letter urging the American public not to vote for Donald Trump. It listed 13 charges against the then Republican nominee and finished with: “Donald Trump is a dangerous, destructive choice for the country. He misinforms the electorate, degrades trust in public institutions with conspiracy theories, and promotes willful delusion over engagement with reality. If elected, he poses a unique danger to the functioning of democratic and economic institutions, and to the prosperity of the country. For these reasons, we strongly recommend that you do not vote for Donald Trump.”On election day more than 60 million Americans either did not see the open letter or disagreed with the economists and elected Trump anyway. The point of this piece will be to demonstrate that Donald Trump’s economic thinking is approaching conspiracy theory levels of ridiculous. Having the Donald as president is concerning because he either: a. thoroughly believes that all these ridiculous protectionist policies will work or b. he knows they are terrible and is purposefully lying to his voters. This piece can be considered a modern day “list of economic grievances.” This is an incomplete list.Phony Numbers or Phony Accusations?The Donald has attacked some of the most sacred and trusted institutions in economics. Notoriously he has been critical of the Bureau of Labor Statistics. The narcissist-in-chief has called the unemployment rate “a phony number to make the politicians look good.” The then candidate Trump claimed that “When you hear 4.9 and five-per-cent unemployment, the number’s probably twenty-eight, twenty-nine, as high as thirty-five in fact, I even heard recently forty-two per cent.” When the labor market was sitting at full employment and not matching up with Trump’s core message of doom and gloom he charged that “The five-per-cent figure is one of the biggest hoaxes in American modern politics.” Donald Trump either needs to devise a more rigorous economic model for unemployment (it cannot determine whether the unemployment rate is in the 20 or 40 percent range) or he needs to stop pulling scary numbers out of Kellaynne Conway’s “handbag”.Trump’s baseless claims against the Bureau of Labor Statistics are beyond laughable idiocy. Unfortunately, because of his position of power he degrades a decades old labor market research institution. The United States’ unemployment rate is arguable the most important statistic in economics. It is a signal that we get about the world’s largest economy. It is not some far removed sum that is irrelevant to the working man, but a percentage that cues to the status of the American worker. This figure is mined like a precious jewel, teams of economists, statisticians and general math nerds conduct a random survey of over 60,000 households asking almost everything besides the household’s name. After collection and dissemination of the data the final estimate is kept under close guard until its release on the First Friday of each month at 8:30am to the waiting journalists, economists, and political advisers. Trump’s fabrication of illegitimacy behind this result is an insult to the whole process and all workers of the BLS. It undermines trust in this invaluable institution.The Bureau of Labor Statistics was not the only agency to have its legitimacy questioned by the president. The monument to the might of the U.S. Dollar, The Federal Reserve and its Chairwomen, have suffered unfounded accusations of “doing political things.” In many cases, both historically and in the present day, central banks have fallen under political pressure and terrorized the monetary system of their respective countries. Owing to its independence, the Federal Reserve has never fallen under such unfortunate circumstances. Although chairs are appointed by Congress and the President, once in power they are free to do as they wish. To preserve independence, presidents never criticize the Federal Reserve. Of course, the Donald has the toddler-like desire to be the first for everything and attempted to delegitimize the backbone of the U.S. financial industry. Thankfully investors agreed with Chairwomen Yellen when she had to clarify “Partisan politics plays no role in our decisions”.Unfortunately, Trump is going to have some control in monetary policy decisions. First, he will have the opportunity to appoint a new Federal Reserve Chair with Janet Yellen’s term ending in 2018. Second, he and his Republican majority are debating passing an “audit the fed” bill. Third, with the resignation of Daniel Tarullo Trump will have yet another position to fill with someone totally unqualified. Any of those actions could led to more distrust with the Fed than any of his accusations have.Trade Deficit or Mental Defecit?The Nobel Laureate economist Paul Krugman has said “If there were an Economist's Creed, it would surely contain the affirmations "I understand the Principle of Comparative Advantage" and "I advocate Free Trade." Former Chair of the Council of Economic Advisers Greg Mankiw polled economists and found that 93% of them agree that “Tariffs and import quotas usually reduce general economic welfare.” Once again Trump wholly disagrees with the intellectual community and has his own ideas on complex issues. Donald is likely the most anti-free trade president to hold office. He has supported insane ideas like a 20% import tax and accused Mexico of somehow taking advantage of the United States because of a VAT. He has threatened a trade war with China and a withdrawal from The World Trade Organization, NAFTA, and has successfully shut down the Trans-Pacific Trade Partnership. NAFTA has been one of Trump’s biggest targets. This over 20 years old free trade agreement establishes the largest free trade bloc in the world. The president has railed against the agreement calling it “the worst trade deal maybe ever signed anywhere” and defective. He has blamed NAFTA for decline in United States manufacturing and argues that the agreement allows Mexico to benefit at our expense. The evidence points to the contrary. While Mexico has in fact benefitted from the trade agreement, trade is not a zero-sum game. All three countries involved have benefitted greatly from the deal. While some workers have been displaced, the new jobs created by trade greatly outweigh the costs. It is estimated that 6 million jobs were created and depend on the trade bloc. Ending it would not only result in higher prices for consumers but also possible action by the World Trade Organization. Trump’s position of power unfortunately grants him the ability to effect U.S. trade. Under article 2205 Trump’s administration could withdrawal from the agreement as long as they gave the member nations 6 months notice. What would unfold would be unprecedented in the modern era. The Donald has already used his presidential position to restrict trade. One of his first actions upon entering office was scrapping the Trans-Pacific Trade Partnership or TTP. With the United States being the world’s largest income, withdrawals not only hurt the U.S. economy but could also influence other countries to leave their trade organizations, such as the European Union.Fiscal Delusions.The United States government is currently running a $500 billion fiscal deficit. While appealing to fiscal conservatives during his campaign, Trumps tax plan is a paragon of fiscal irresponsibility. The Tax Foundation, a conservative D.C. based think tank, estimates that Trump’s tax plan will reduce federal revenues by $4.4 trillion to $5.9 trillion over a 10 year period. Surprisingly, this is an improvement upon an earlier tax plan which was going to decrease revenue by as much as $12.3 trillion. Trump gives even further evidence that he is an inter-dimensional being living mainly in an alternative reality by saying, despite all the tax cuts, he plans to pay off the entire nearly $20 trillion national debt in just 8 years. When asked how he plans to accomplish this, which would require setting aside at least 2 trillion every year to pay debt holders, Trump said “ I could do it fairly quickly, because of the fact the numbers”. He plans to not include a single tax increase and believes the $2 trillion can be made up solely on renegotiating trade deals. To such an idea everyone, from academic economists to the guy who only skips Econ 104 on Fridays, says WRONG!If one were looking to build a blueprint or design for a monument to human ignorance Trump’s proposed border wall would be a good start. While still in the conceptual process, the wall is estimated to cost around $750 million dollars on an extremely conservative estimate and will continue to cost hundreds of millions of dollars a year to guard and maintain. This proposed wall will face various physical challenges such as a reservoir that is nearly 4 miles across, mountains, and the basic challenge of keeping the wall far enough away from the Rio Grande River to avoid flood but not too far that it puts U.S. homes on the wrong side. The wall would also be one of the largest, if not the largest, use of eminent domain in U.S. history. As a GAO report stated: “federal and tribal lands make up 632 miles, or approximately 33 percent, of the nearly 2,000 total border miles. Private and state-owned lands constitute the remaining 67 percent of the border, most of which is located in Texas”(p.5). With the wall, the hallmark of Donald Trump’s campaign, being so costly, we must ask, is it worth it? While the president may paint a picture of an economy and society ravaged by waves of Mexican “illegals”, net immigration on our southern border has been negative for many years. On top of that, around 45% of the current undocumented population came here legally, through border checkpoints or at airports, and simply overstayed their visa. Also, the largest increase in undocumented immigrants have been from Asia, particularly China and India, and a wall will obviously not halt this flow. Although the wall will do little to prevent undocumented immigration, is that even a proper objective? I have written on the Optimal Bundle blog before that immigration, whether legal or illegal, is at worse a small positive for U.S. workers. All that I truly believe the wall will accomplish is two horrible results. First, send an awful signal to our southern neighbor that their people are not wanted. Second, feed the hungry racists who wanted a concrete wall to prevent their neighbors from being non-white or speaking another language.We have truly entered the post-truth era. Evidence based policy has been replaced by alternative facts, and the hateful feelings of nativism decide government action. Our current president was elected, despite his constant lies. His economic naivety is only a small fraction of his profound ignorance to reality. Honestly, nothing saddens me more than to see years of economic research put aside in favor of a loud talker. Hopefully, after this step back we can take 5 more forward. This election, like nothing else, has demonstrated the economic ignorance of vast numbers of the electorate. As students of economics we are given one duty, educate our peers.

The Optimal Bundle Spring Edition: Volume 29

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on the inclusion of re-exports in United States trade data. Other topics covered are suspicions of corruption in South Korean conglomerates, Saudi Aramco’s partial privatization, and a fictional terrorist attack in Sweden.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Spring Edition: Volume 28

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on the necessity of central bank independence. Other topics covered are the repeal of Dodd-Frank, the feasibility of Trump’s budget, and anti-corruption protests in Romania.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Spring Edition: Volume 27

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on the importance of freedom of the press. Other topics covered are the first week of the Trump presidency, new partisan dating websites, and millennials’ supposed “addiction” to technology.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 26

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an investigation of the competitiveness of the United States and Gulf state airline industries. Other topics covered are pro-democracy and anti-separatist protests in Hong Kong, the upward trend in American consumer spending, and Donald Trump’s upset victory last week.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 25

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed making the case for marijuana legalization. Other topics covered are the October jobs report, election-related stock market volatility, and a new American entertainment acquisition by Wanda Group.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Special Edition: Volume 24

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle focuses on the 2016 United States presidential election. The op-ed addresses funding for public higher education institutions. Other topics covered are the third-party candidates’ economic policy proposals, Clinton and Trump’s energy policy platforms, and possible reforms to the healthcare industry.This is an online version of the print edition of the Optimal Bundle.

Make America Sane Again

The Perils of Trump: Why Donald Trump is the Gravest Existential Threat to the U.S. Economy Since World War II

Donald Trump has run a presidential campaign branded on populism which rejects the global and domestic economic system developed by the two major political parties since World War II. Though politically appealing to a large segment of the population, Trump’s economic policies endanger the U.S. economy exponentially more than those of any presidential candidate of a major U.S. political party in history. The most severe (and hardly the only) economic dangers of a Trump presidency include the erosion of the dollar’s status as the world’s reserve currency, a recession longer than the one in the late 2000s, and the end of U.S. government debt’s status as the least risky asset in the world. If any of these three dangers are realized, there will be a sudden and indefinite collapse in the investment of stocks and real estate that Americans depend on for retirement and employment with firms of all sizes. For these reasons, Trump is the most irrational choice this year’s American voters have ever had in their lifetimes.By Adam SmithEditor’s Note: The views expressed by this author do not reflect the official views of the Penn State Economics Association or the views of the employers of any current or former member of the Penn State Economics Association. For purposes of ensuring readers do not infer otherwise, the author of this post is using a pseudonym.The intellectual level of public discourse in the United States has been reduced to that of a third-grade elementary school student. This is not hyperbole; that is actually the reading level of Donald Trump’s diction during the past year-and-a-half. This would only be a mild nuisance if Trump was just bungling the United States Football League, suing a securities analyst for correctly predicting the failure of the Trump Taj Mahal, or “literally sold almost no steaks” in his hilariously awful business plan to sell Trump Steaks at The Sharper Image. Yet, Trump—a man with no government experience, breathtakingly scant public policy knowledge, and horrendous personal character—is somehow the Republican Party’s nominee for President and FiveThirtyEight’s Polls-Plus Model projects he has roughly a 35% probability of winning the general election on Tuesday.Sadly, the comical failures listed above understate Trump’s failures as a business executive and fail to adequately articulate the dangers of his potential ascendance to the Presidency. Trump’s stated net worth of $2.9 billion means the real estate mogul underperformed four decades of returns on the real estate market (FTSE NAREIT All Equity REITS Index) by 57%, or left $13.2 billion on the table because of his bad decisions like the Trump Taj Mahal. Setting aside for now the specious logic underlying his economic policies, Trump has no experience in his business career that should inspire confidence in the public that he is qualified for the Presidency.To the contrary, his boasting on tape of having committed acts that are legally defined as sexual assault, refusal to disavow support from Ku Klux Klan Grand Wizard David Duke, demagogic rhetoric and policy proposals attacking Muslims and Mexicans, and shameful personal indulgence of donations belonging to a private charity are just a few of the many actions which rightfully make investors and citizens fearful of political and economic instability if he wins the election. Trump’s actions validated the reported decisions of Republicans like Ohio Governor John Kasich, U.S. Senator John McCain of Arizona, former Florida Governor Jeb Bush, former U.S. Presidents George H.W. Bush and George W. Bush, former Secretary of Defense Colin Powell, former Secretary of State Condoleezza Rice, and former Massachusetts Governor Mitt Romney to take a stand against their own party’s presidential nominee. Far more important than Trump’s underwhelming business record, the fact that Trump does not deserve the unity of his own party makes it impossible to conclude he can unite Congress behind sound economic policies. These factors are responsible for the apprehension of global investors and consumers as the election looms, but Trump’s feeble attempts at policy prescription—inseparable from the demagoguery he has displayed in this election campaign—is arguably the biggest source of anxiety of all.The World is Watching: Trump’s Abandonment of Globalization Would Threaten America’s Status as the Safe Haven of Financial MarketsThe mythology that Trump is a business genius who would correct the (admittedly real) partisan dysfunction in Washington, D.C. inevitably leads to the dangerous abandonment of the foundations of global economic growth since World War II. It is also an abandonment of the Republican Party’s stance for decades in favor of free trade. The essence of Trumpism is the notion that foreign entities—namely corporations and governments, but also notably refugees and illegal immigrants—are conspiring to undermine American institutions. In his attempt to argue this point, Trump claims, “We’re losing a tremendous amount of money, according to many stats, $800 billion a year on trade…So we are spending a fortune on military to lose $800 billion. That doesn’t sound like it’s smart to me.” His prescription? A 45% tariff on Chinese imported goods, a 35% tariff on Mexican imported goods, and repeal of trade agreements like the North American Free Trade Agreement. It underlies a pathos appeal which resonates with Americans nostalgic for the more closed economy their parents and grandparents experienced before World War II. It also fundamentally misrepresents the United States’ role in the global economy and ignores the benefits it reaps from globalization.As New York Times economic correspondent Neil Irwin writes, “trying to eliminate the trade deficit could mean giving up some of the key levers of power that allow the United States to get its way in international politics.” The dollar has been a global reserve currency since the Bretton Woods agreement in 1945, meaning that parties around the world use it for transactions in which the U.S. has no direct involvement. Its status as the centerpiece of global finance gives the U.S. government unparalleled power to enforce sanctions against Iran, Russia, North Korea, and terrorist groups by cutting off access to the dollar payments system to any bank in the world. Isolationists within Trump’s base of support might shrug at this benefit, but the U.S.’s power in the international political sphere is inseparable from the dollar’s status as a reserve currency. Moreover, amidst the 2008 financial crisis, U.S. government debt saw its interest rates fall when other countries’ rose because of Treasury securities’ unique status as the safe-haven asset. The United States is unique among national economies in its ability to borrow cheaply to provide fiscal stimulus when it experiences a recession and when the federal funds rate is at the zero lower bound.All of this is relevant to Trump’s protectionist trade proposals because economist Robert Triffin warned that the provider of the global reserve currency must run perpetual trade deficits to keep the financial system stable. When nearly every country has a use for dollars, the upward pressure on demand for dollars makes exports more expensive and puts downward pressure on the price of imports in the U.S. In the 1940s, the U.S. was uniquely suited to be the global reserve currency due to the relative strength of its economy and standing as the global military superpower. It is because of the U.S. government’s continued spending on vast domestic infrastructure projects and military to secure hegemony that there is unmatched global demand for the dollar as a reserve currency. What other country could be safer for investing than the producer of the global reserve currency?Furthermore, it is evident Trump’s claim that perpetual trade deficits are a sign foreign countries are taking advantage of the U.S. is flatly wrong. It is true that when China netted a $366 billion trade surplus with the U.S. in 2015 that the Gross Domestic Product (GDP) for the U.S. was reduced at first, but something had to happen with that extra sum of money. If Chinese investors keep the money at home, the Chinese yuan would appreciate and goods would become more expensive in the U.S., thus negating the gains of its exporters. Instead, China and other export-intensive countries prevent their currencies from rising too high by investing in U.S. stocks and bonds, investing in factories in the U.S., or having the government buy assets directly. Far from being an inherent drag on the economy, the nature of these persistent trade deficits experienced by the U.S. are arguably the mechanism which make it the safe haven financial market of the world.This upward pressure on American assets provides high valuation of stocks and real estate, as well as low interest rates on fixed income assets relative to other countries, give American companies a unique advantage in financing. The effect is an advantage for those seeking to retire by generating a sufficient return on their investments. But if Trump signs the intensely protectionist legislation he is proposing and other countries respond with retaliatory tariffs of their own, the consequent slowdown in international trade could be enough to erode the status of the U.S. economy as a global safe haven and dramatically hit the wallets of Americans from every income bracket.The King of Debt: How Trump’s Fiscal Policies Would Explode the National Debt and Borrowing CostsWhile Trump deviates from the orthodoxy of the Republican Party on trade, he doubles down on it for the issue of taxation. Trump’s track record of insolvency in his business career and his actual proposals suggest a massive expansion of tax cuts and an increase in government debt far eclipsing that of his opponent. Yet, this in itself is not inherently alarming. Fiscal stimulus can be useful when monetary policymakers struggle with the zero lower bound (the effective federal funds rate is still historically low around 0.40%), as long as the stimulus is directed to activity which expands the economy. The problem with Trump’s version of fiscal stimulus is twofold: the nature of it is inefficiently allocated and the size of it undermines the creditworthiness of the federal government.It is not surprising that Trump unveiled a plan to significantly cut personal income tax rates due to the inherent positive reception of voters to receiving a tax cut. Bloomberg writer Richard Carroll shows there are some instances where tax cuts were a sensible solution to stimulating the economy, but also some where they failed to accomplish this end due to different economic conditions. The tax cuts proposed by John F. Kennedy and signed by Lyndon B. Johnson in 1964 successfully contributed to about 4.5% GDP growth for six years and shrank the debt-to-GDP ratio because marginal tax rates had been extraordinarily high—up to 91% for personal income (the top bracket). Ronald Reagan’s tax cuts made sense in 1981 because high inflation had arbitrarily pushed individuals into higher income brackets and firms had newfound incentives to invest with some additional fiscal stimulus in an environment of high interest rates. The main pitfall of Trump’s tax plan is the same as the one implemented by George W. Bush in 2001: tax cuts are not a magical panacea to every economic situation. In 2001, the job market was around full employment with an unemployment rate around 4.7%, the debt-to-GDP ratio remained moderately high at 56.4%, and the effective federal funds rate was relatively low at 3.97%. Consequently, GDP only saw an average increase of 2.7% between 2002 and 2006, following a stretch of five years where annual GDP growth exceeded 4% four times. Meanwhile, the debt-to-GDP ratio expanded by 28.8% during Bush’s presidency. Now, the unemployment rate is similarly low at 4.9%, debt-to-GDP is even higher around 75%, and the federal funds rate is even lower around 0.40%. The current economic conditions are even less suited to generate significant additional growth upon the injection of a large tax cut.Furthermore, the allocation of Trump’s tax cuts is primarily to high-income consumers who spend a significantly smaller proportion of any reduction in their taxes than do lower and middle-income consumers. Moody’s Analytics calculated the marginal propensity to consume (percent of income consumed) of those in the top income quintile to be 0.49 and these individuals would receive 72% of Trump’s tax cuts. That means only 49 cents of every dollar in the vast majority of Trump’s tax cuts would add to consumption in the U.S. This is in contrast to the bottom-quintile, whose marginal propensity to consume is 0.86 and would receive 2% of Trump’s tax cuts. Cutting taxes for lower-income earners, or enacting other fiscal policies which boost their incomes, is simply more efficient at stimulating consumption in the economy as a whole.This does not, in itself, refute the merits of cutting taxes primarily for high-income earners and capital gains income. If firms were constrained from expanding because of high borrowing costs, these individuals could use their savings to invest in them when they badly need capital. The problem with using that as a reason for implementing Trump’s plan now—in contrast to Reagan’s Presidency—is that the current market environment is such that stocks are very expensive: the S&P 500 has a historically high price-to-earnings ratio of 24.31, as of October 28. The P/E ratio was very low at 9.02 at the beginning of 1981, Reagan’s first year as President. Firms simply haven’t been having a problem raising capital because investors are in search for yield. Higher demand for financial assets would probably do little to increase future earnings. In essence, the marginal impact of Trump’s tax plan on economic growth would be underwhelming compared to past tax cuts.Of course, many of Trump’s supporters are likely to favor his plan not because they think it will stimulate the economy, but simply because they want to have more after-tax income. They should be warned they could easily actually be worse off under Trump’s tax and spending plans, especially if these individuals are not in the top income quintile. Moody’s Analytics wrote that if Trump’s plan is adopted at face value, the “nation’s debt load rises from 75% of GDP currently to over 100% by the end of Mr. Trump’s first term and more than 130% a decade from now. Long-term interest rates are much higher as a result. Over the next decade in the scenario where Trump wins the election, 10-year Treasury yields are expected to average 6.6%, compared with near 4% in the current-law scenario. Businesses’ cost of capital and households’ borrowing costs are much higher, despite the lower marginal rates, which act as a corrosive on investment and ultimately on productivity and GDP growth.” With the job market around full employment (4.7% unemployment) and Trump’s refusal to alter the largest drivers of increased government spending—Social Security and Medicare, it is likely that there would be quick crowding out effects under his fiscal policies: “the increased government borrowing causes interest rates to increase, crowding out private sector activities such as business investment, housing, and consumer spending on vehicles and other durables.” Ready or not, the self-proclaimed king of debt will surely live up to his name.The Trump Recession: A Perfect Storm The best case scenario of Trump’s economic plan is that there is an economic recession that is not as severe as the one in the late 2000s, but more prolonged. The worst is a catastrophe that has never happened before and would throw the basic principles of finance out the window.Along with the higher interest rates arising from his fiscal policies, Trump’s steep taxes on imports would hit the wallets of most Americans by increasing the prices of many goods ranging from groceries to clothing. It would replicate the effects of the Hawley-Smoot tariff law signed by Herbert Hoover during the Great Depression and similarly shrink global output at the worst possible time. Furthermore, Trump’s hardline plan to deport millions of illegal immigrants would also add to inflationary pressure by increasing the cost of labor for firms and decreasing output due to the lower labor supply. As a result, Moody’s forecasts the Federal Reserve to respond to this inflationary pressure with an increase in the federal funds rate in accordance with its congressional mandate to stabilize inflation.If Trump is elected and gets most of his policies adopted even in a modified form, Moody’s model forecasts all of these factors would cause a recession beginning in 2018 that would last longer than the 2000s Great Recession. The model predicts it would result in 3.5 million Americans losing their jobs, unemployment rising to 7%, and a sizable fall in home prices and stocks. Movements in futures contracts during the presidential campaign also provide a strong signal that investors would price in the effects of Trump’s policies as soon as Wednesday. During the first general election debate, Trump’s odds of winning fell by 5.2% and S&P 500 futures rose by 0.8%. Given that there were no other significant news events during this two-hour window and that price movements are typically minimal then, it is reasonable to assume a direct connection between these two shifts. It corresponds to a 15.38% difference in the value of the S&P 500 between a certain Trump victory and a certain Trump loss.Though the expected effect of Trump’s presidency on the population’s wealth is large, this is largely due to the uncertainty of what events his election would bring. It is possible that Trump would govern as a more conventional politician than his rhetoric suggests, so volatility in both financial markets and the real economy could be mitigated. On the other hand, it is also possible (and in my opinion, more likely—considering that Trump’s only consistent trait is his erratic behavior) that the market has not priced in the full extent of Trump’s irrationality and its economic consequences.Take, for instance, Trump’s suggestion that “[b]ringing back the gold standard would be very hard to do, but, boy, would it be wonderful. We'd have a standard on which to base our money.” The events of the Great Depression demonstrate that the gold standard was actually a disastrous policy. According to Wall Street Journal economics commentator Greg Ip, “In 1929, a recession in the United States caused prices, output and imports to plunge and the trade surplus to surge. This drew in gold from its trading partners, forcing them to raise interest rates. When European central banks tried to ease monetary policy, speculators guessed they would devalue, and pulled their gold out, causing the money supply to contract.” If Trump had appointed individuals who espoused these ideas to the Federal Reserve Board of Governors prior to the 2008 financial crisis, the Fed would have been unwilling to expand the money supply by lowering the federal funds rate and undertaking quantitative easing—the central bank’s purchase of long-term Treasuries and other fixed-income assets which kept interest rates low in the aftermath of the crisis. The recession would have literally followed the script of the Great Depression.But the worst scenario of all becomes horrifyingly plausible to imagine when one considers Trump’s comments that he would not pay back the government’s creditors in full in the event that there is a recession in his presidency: “You go back and say, hey guess what, the economy just crashed. I’m going to give you back half.”A few recent events suggest this idea (and Trump’s track record of undertaking similar actions as a business executive) could lead to catastrophic volatility in financial markets eclipsing the 2008 crisis in severity. For instance, Congress already flirted with a default on Treasuries in 2011 (and again in 2013) when $6 trillion of value from global stocks was eliminated by the time the two parties agreed to raise the debt ceiling. Moreover, the $19.8 trillion of outstanding government debt is more than 38 times the $517 billion Lehman Brothers owed when it filed for bankruptcy, and the stock market lost almost half its value in the five months after that happened. A big reason why Lehman’s collapse was so devastating was because its counterparties discovered the collateral they thought was backing their loans in the repo market couldn’t be returned. This problem would be even worse if Trump does not pay back creditors in full because at least $2.8 trillion of Treasuries served as collateral for repo and reverse repo loans as of 2013 (likely more Treasuries serve as collateral since that time), according to Fed data. If Treasuries were no longer eligible as collateral, the losses for lenders and borrowers could be unprecedented. This has never happened before, so it is impossible to quantify the damage precisely. However, the idea of $19.8 trillion in risk-free assets suddenly taking a haircut means markets would have to price in an unprecedented high risk discount to nearly all assets ranging from stocks to houses. It would be a recipe for millions of Americans to foreclose on their homes and firms to collapse. Modern portfolio theory would be moot.Trump did walk back his comments, but he demonstrated a hazy (at best) understanding of public finance in the process. He still has not retracted his support for Congressional Republicans’ failed attempt to defund Planned Parenthood and force another government shutdown in 2015, suggesting he remains willing to use the risk-free status of Treasuries as a political football. Trump should instead heed the advice of Warren Buffett who said of using the debt limit as a weapon, “It should be like nuclear bombs, basically too horrible to use.” Of course, Trump has apparently not fathomed that actual nuclear bombs are too horrible to use either. Don’t hold your breath, America. SourcesBerman, Russell. “Donald Trump Brings Back the Talk of Default.” The Atlantic. 22 Jun. 2016. http://www.theatlantic.com/politics/archive/2016/06/donald-trump-brings-back-the-default-talk/488270/Carroll, Richard. “When Ideology and Tax Cuts Mix, the Economy Loses.” Bloomberg. 27 Jun. 2012. https://www.bloomberg.com/view/articles/2012-06-27/when-ideology-and-tax-cuts-mix-the-economy-is-the-loser“Donald Trump won’t take nuclear weapons off the table.” MSNBC. 30 Mar. 2016. http://www.msnbc.com/hardball/watch/donald-trump-won-t-take-nukes-off-the-table-655471171934Everett, Burgess. “Trump: Shut down the government to defund Planned Parenthood.” Politico. 4 Aug. 2015. http://www.politico.com/story/2015/08/donald-trump-government-shutdown-planned-parenthood-120981Farenthold, David A. “Trump bought a 6-foot-tall portrait of himself with charity money. We may have found it.” The Washington Post. 14 Sep. 2016. https://www.washingtonpost.com/politics/a-clue-to-the-whereabouts-of-the-6-foot-tall-portrait-of-donald-trump/2016/09/14/ae65db82-7a8f-11e6-ac8e-cf8e0dd91dc7_story.htmlFarenthold, David A. “Trump recorded having extremely lewd conversation about women in 2005.” The Washington Post. 7 Oct. 2016. https://www.washingtonpost.com/politics/trump-recorded-having-extremely-lewd-conversation-about-women-in-2005/2016/10/07/3b9ce776-8cb4-11e6-bf8a-3d26847eeed4_story.html“FiveThirtyEight 2016 Election Forecast.” FiveThirtyEight. 6 Nov. 2016. http://projects.fivethirtyeight.com/2016-election-forecast/?ex_cid=rrpromo#plusGraham, David A. “Which Republicans Oppose Donald Trump Cheat Sheet.” The Atlantic. 6 Nov. 2016. http://www.theatlantic.com/politics/archive/2016/11/where-republicans-stand-on-donald-trump-a-cheat-sheet/481449/Ip, Greg. “What Republicans Get Wrong About the Gold Standard.” The Wall Street Journal. 12 Nov. 2015. http://blogs.wsj.com/economics/2015/11/12/greg-ip-what-republicans-get-wrong-about-the-gold-standard/Irwin, Neil. “What Donald Trump Doesn’t Understand About the Trade Deficit.” The New York Times. 21 Jul. 2016. http://www.nytimes.com/2016/07/22/upshot/what-donald-trump-doesnt-understand-about-the-trade-deficit.html?_r=1Jacobson, Louis. “A closer look at Donald Trump’s comments about refinancing U.S. debt.” Politifact. 16 May 2016. http://www.politifact.com/truth-o-meter/article/2016/may/16/closer-look-donald-trumps-comments-about-refinanci/Johnson, Jenna. “Donald Trump is expanding his Muslim ban, not rolling it back.” The Washington Post. 24 Jul. 2016. https://www.washingtonpost.com/news/post-politics/wp/2016/07/24/donald-trump-is-expanding-his-muslim-ban-not-rolling-it-back/Jubera, Drew. “How Donald Trump Destroyed a Football League.” Esquire. 13 Jan. 2016. http://www.esquire.com/news-politics/a41135/donald-trump-usfl/Kruse, Michael. “The Man Who Beat Donald Trump.” Politico. 25 Apr. 2016. http://www.politico.com/magazine/story/2016/04/donald-trump-marvin-roffman-casino-lawsuit-213855Marans, Daniel. “Trump Opposes Cutting Social Security From A ‘Moral Standpoint’.” The Huffington Post. 31 May 2016. http://www.huffingtonpost.com/entry/donald-trump-supports-cutting-social-security-report-says_us_5749db63e4b0dacf7ad515e4Nelson, Louis. “Trump: ‘I’m the king of debt.’” Politico. 22 Jun. 2016. http://www.politico.com/story/2016/06/trump-king-of-debt-224642Onaran, Yalman. “A U.S. Default Seen as Catastrophe Dwarfing Lehman’s Fall.” Bloomberg. 7 Oct. 2013. http://www.bloomberg.com/news/articles/2013-10-07/a-u-s-default-seen-as-catastrophe-dwarfing-lehman-s-fallQiu, Linda. “Donald Trump’s absurd claim that he knows nothing about former KKK leader David Duke.” Politifact. 2 Mar. 2016. http://www.politifact.com/truth-o-meter/statements/2016/mar/02/donald-trump/trumps-absurd-claim-he-knows-nothing-about-former-/Qiu, Linda. “Yep, Donald Trump’s companies have declared bankruptcy…more than four times.” Politifact. 21 Jun. 2016. http://www.politifact.com/truth-o-meter/statements/2016/jun/21/hillary-clinton/yep-donald-trumps-companies-have-declared-bankrupt/Shafer, Jack. “Donald Trump Talks Like a Third Grader.” Politico. 13 Aug. 2015. http://www.politico.com/magazine/story/2015/08/donald-trump-talks-like-a-third-grader-121340Smith, Elliot Blair. “How Donald Trump left $13 billion on table.” Marketwatch. 1 Mar. 2016. http://www.marketwatch.com/story/how-donald-trump-left-13-billion-on-table-2016-03-01Stuart, Tessa. “Donald Trump’s 13 Biggest Business Failures.” Rolling Stone. 14 Mar. 2016. http://www.rollingstone.com/politics/news/donald-trumps-13-biggest-business-failures-20160314Wolfers, Justin. “Debate Night Message: The Markets Are Afraid of Donald Trump.” The New York Times. 30 Sep. 2016. http://www.nytimes.com/2016/10/02/upshot/debate-night-message-the-markets-are-afraid-of-donald-trump.html?_r=1Ye Hee Lee, Michelle. “Donald Trump’s false comments connecting Mexican immigrants and crime.” The Washington Post. 8 Jul. 2015. https://www.washingtonpost.com/news/fact-checker/wp/2015/07/08/donald-trumps-false-comments-connecting-mexican-immigrants-and-crime/Zandi, Mark, et. al. “The Macroeconomic Consequences of Mr. Trump’s Economic Policies.” Moody’s Analytics. 17 Jun. 2016. https://www.economy.com/mark-zandi/documents/2016-06-17-Trumps-Economic-Policies.pdfZarroli, Jim. “Trump Favors Returning To The Gold Standard, Few Economists Agree.” NPR. 16 Jun. 2016. http://www.npr.org/2016/06/16/482279689/trump-favors-returning-to-the-gold-standard-few-economists-agree

Save to Save Yourself

By Anthony Campano

Saving is a practice often preached to young adults who have just entered the workforce, yet pushed aside in certain occasions, such as moving out of your parents’ house or buying a new car. However, CNBC released a statistic that should strike you as remarkable: “47 percent of Americans said they could not afford an emergency expense of $400.” Living outside of our means is a major problem in America, and we as a country should be trying to resolve the situation with much more enthusiasm than we are.A number of rich countries--most notably Japan--are starting to experience economic woes associated with the aging of the population. For America, this problem is on its way, albeit in the form of an entitlement crisis. With almost half of the country saving nearly nothing for their retirement costs, Social Security is predicted to spend even more money than it will bring in (it already does this today). The baby-boom generation is growing closer to retirement, and with the threat of more people being out of the workforce than in it, an enormous decision will have to be made on what to do about Social Security. At the microeconomic level, households will grapple with greater dependency burdens.The burden will be felt by yours truly, the future American taxpayer from the X and the Millennial generations. Therefore, our generation will face the task of correcting this problem. Do we blame the older population for not saving, or do we “take one for the team” and pay substantially higher tax rates? This issue is in no way black or white, as there are many reasons as to why the older generations have little to none in their savings account. First off, that 47% is four percent more than the amount of people that live paycheck-to-paycheck. The key fact cited in defense of these lower-middle class citizens is the ‘starvation’ wage of $7.25 an hour. Is this a wage that is sufficient enough to save the recommended slightest amount of 10% off of every payday? Second, in an argument provided by Forbes, “Social Security is the only government-sponsored inflation-adjusted retirement payment for life. Ask your employer if they will convert your 401(k) to a guaranteed, life-time inflation-indexed annuity. After the laughing stops, you’ll have a different attitude about Social Security.” By not allowing workers to take advantage of the Social Security perks, you are putting their retirement plans into the hands of the CEO. For example, Wal-Mart--America’s biggest employer--is considered to only focus on excessive profit maximization, not the economic welfare of their low wage workers, who have no education and no one else looking out for their financial stability. From the other standpoint, why should it be on us to pay for the financial burdens of older generations? Was it us who were poorly saving or investing in unaffordable houses? No, but the moral of the story is that we must abandon these financial habits of the previous generations, and figure out how to handle the mess. How we, the millions of young adults today, decide to handle these challenges will shape our way of life, and most likely set the standards for financial sustainability for generations to come. We cannot take this choice lightly.Sources:http://www.pbs.org/newshour/making-sense/can-you-guess-how-many-americans-have-absolutely-no-savings-at-all/http://fivethirtyeight.com/features/what-baby-boomers-retirement-means-for-the-u-s-economy/http://www.cnbc.com/2016/06/21/66-million-americans-have-no-emergency-savings.html

The Optimal Bundle Fall Edition: Volume 23

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features two op-eds: one comparing the effects of the presidential candidates’ policies on short-run and long-run economic growth and another drawing attention to the politics of the Nobel Prize in Economics. Other topics covered are the aftermath of the Wells Fargo scandal and Facebook’s new business communication platform, Workplace.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 22

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on the death penalty. Other topics covered are potential monetary policy changes by the Federal Reserve, the creepy clown craze, the 2016 Nobel Prize in Economics, and Samsung’s Note 7 recall.This is an online version of the print edition of the Optimal Bundle.

In With Migrants, Out With Xenophobia

By Pete Scharf

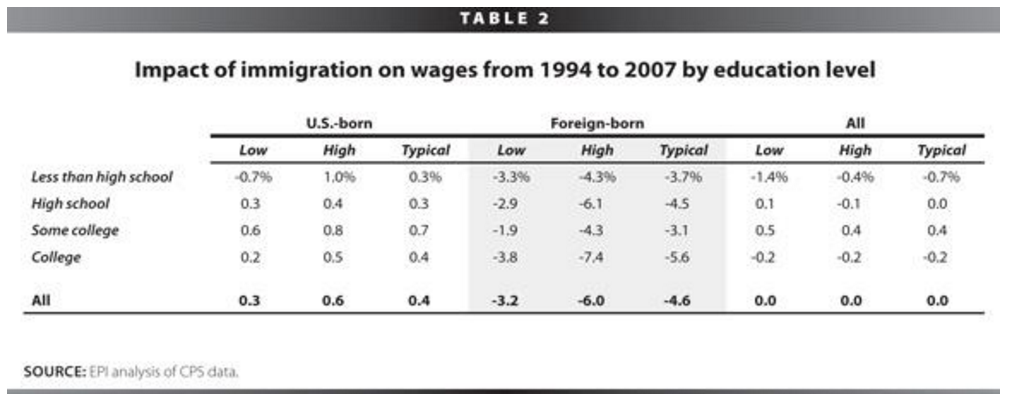

“Decades of record immigration have produced lower wages and higher unemployment for our citizens. We are going to have an immigration system that works, but one that works for the American people.” - Donald Trump, RNC acceptance speech[1]Throughout his presidential campaign, Republican nominee Donald Trump has accused immigrants of bringing crime, suppressing wages, and abusing our welfare system. In Europe, the fear of immigration’s negative consequences has propelled far right anti-immigration parties to victory in Switzerland[2], France[3], and Poland[4], among others, and indeed was the main contributor to the UK’s decision to leave the European Union. The perceived negative economic impacts are keeping even more left-leaning politicians like Bernie Sanders skeptical of immigration.[5] Although there may be some legitimate arguments against immigration from a national security standpoint, the economic argument is strongly in favor. Immigration, for the most part, does not depress wages, hamper growth, or create unemployment. Instead, immigration is a sign of a healthy economy and is a benefit both to the immigrants seeking a better life and to the native worker.The idea of wage suppression is a common argument against increased immigration. The Trump campaign claims their restrictive immigration policy will boost native wages, and the argument goes like this: immigration shifts the labor supply curve to the right, which leads to a drop in equilibrium price of labor, leaving all workers with lower wages. This line of reasoning, however, entirely ignores the demand-side effects of immigration. Immigrants who come here to make money also go out and spend it, thus creating demand and often more than offsetting the increase in supply. Foged and Peri (2013) studied the wage of unskilled Danish workers and found that increases in the labor force caused by immigration actually raised the wages of unskilled native workers.[6] Similar studies have found small positive results on native wages with at most minor negative changes to unskilled workers. As shown in the table below, a study by the Economic Policy Institute found the only decrease in wages occurred for foreign workers who had to compete directly with new immigrants. Native workers’ wages remained nearly unchanged, and at times enjoyed small positive effects.[7] Negative wage impacts primarily occur for foreign born workers who directly compete against newer immigrants. U.S.-born workers’ wages remained almost unchanged with slight positive effects.[7]A second malady blamed on immigrants is unemployment. Critics argue that immigrants coming into the country compete for jobs U.S. workers currently hold, and are willing to take them at lower wages, leading to unemployment among native workers. Empirically, however, this has simply not been the case. Islam (2013) found no effect of immigration on unemployment.[8] In fact, the opposite was true: lower unemployment increased immigration. A lower unemployment rate was a signal of a healthy labor market that would attract immigrants. In times of high unemployment, immigration waned only to pick back up again when the labor market turned around.

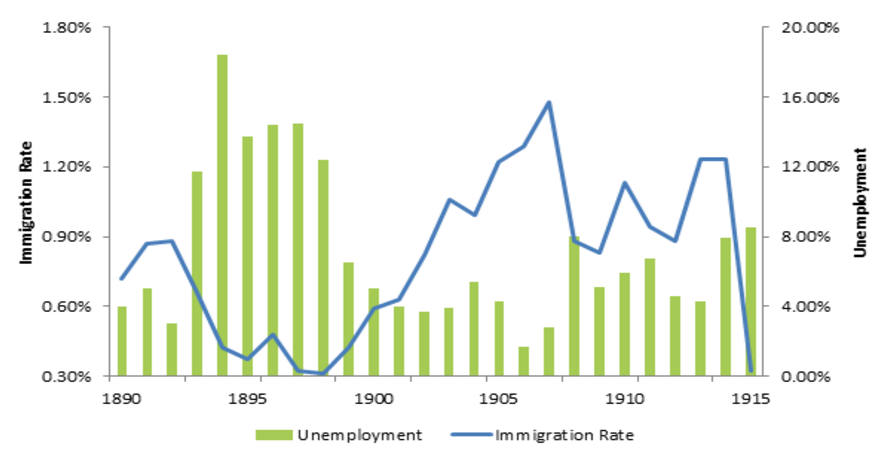

Negative wage impacts primarily occur for foreign born workers who directly compete against newer immigrants. U.S.-born workers’ wages remained almost unchanged with slight positive effects.[7]A second malady blamed on immigrants is unemployment. Critics argue that immigrants coming into the country compete for jobs U.S. workers currently hold, and are willing to take them at lower wages, leading to unemployment among native workers. Empirically, however, this has simply not been the case. Islam (2013) found no effect of immigration on unemployment.[8] In fact, the opposite was true: lower unemployment increased immigration. A lower unemployment rate was a signal of a healthy labor market that would attract immigrants. In times of high unemployment, immigration waned only to pick back up again when the labor market turned around. Immigration and unemployment during a period of heavy immigration (1890-1915). The drop in immigration in 1914 is attributed to World War I.[9]Lastly, many assume immigration has a negative impact on the welfare programs in the United States. They claim immigrants utilize our public assistance programs without contributing equal amounts in taxes, which either raises taxes on U.S. citizens or causes the financial ruin of these programs. In reality, the federal government does not allow this to occur: “With many important exceptions, Qualified Aliens are ineligible for the Supplemental Nutrition Assistance Program (SNAP formerly the Food Stamp Program) and SSI. States have the authority to determine their eligibility for TANF, SSBG, and Medicaid. With some exceptions, Qualified Aliens entering the country after August 22, 1996, are denied Federal means-tested public benefits for their first five years in the U.S. as qualified aliens.”[10] A Harvard study looking at Medicare, a program immigrants can utilize under certain circumstances, found “immigrants made 14.7 percent of Trust Fund contributions but accounted for only 7.9 percent of its expenditures—a net surplus of $13.8 billion. In contrast, US-born people generated a $30.9 billion deficit.”[11] The policy and the research suggest that if anything, immigrants put more into welfare programs than they take out.While immigrants are a source of cash flows to the federal government, they may constitute a fiscal burden for state and local governments. This is primarily because immigrants are poorer on average than U.S.-born taxpayers, and thus foot a smaller tax bill. A National Research Council study concluded that although immigrants are a fiscal positive to the federal government of about $105,000 over the course of their lifetime, they are a fiscal negative for state governments to the tune of $25,000.[12] However, the loss by state governments could be completely eliminated by the immigrants’ positive macroeconomic impact.The research is clear: the benefits of immigration greatly outweigh its small risks and miniscule negative consequences. Politicians often wrongfully paint immigrants as leeches wishing to enter our country to steal our jobs, lower our wages, and drain our welfare resources; these claims run counter to most economic evidence. We need to support candidates and policies that further liberalize immigration, not hamper it. When an immigrant comes to the United States, they not only better their own life, but the lives of their American neighbors.The Experts Agree

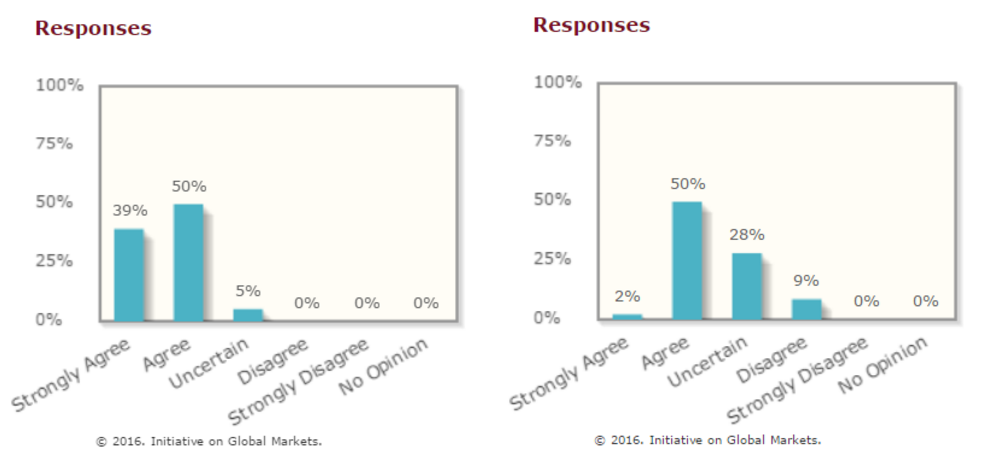

Immigration and unemployment during a period of heavy immigration (1890-1915). The drop in immigration in 1914 is attributed to World War I.[9]Lastly, many assume immigration has a negative impact on the welfare programs in the United States. They claim immigrants utilize our public assistance programs without contributing equal amounts in taxes, which either raises taxes on U.S. citizens or causes the financial ruin of these programs. In reality, the federal government does not allow this to occur: “With many important exceptions, Qualified Aliens are ineligible for the Supplemental Nutrition Assistance Program (SNAP formerly the Food Stamp Program) and SSI. States have the authority to determine their eligibility for TANF, SSBG, and Medicaid. With some exceptions, Qualified Aliens entering the country after August 22, 1996, are denied Federal means-tested public benefits for their first five years in the U.S. as qualified aliens.”[10] A Harvard study looking at Medicare, a program immigrants can utilize under certain circumstances, found “immigrants made 14.7 percent of Trust Fund contributions but accounted for only 7.9 percent of its expenditures—a net surplus of $13.8 billion. In contrast, US-born people generated a $30.9 billion deficit.”[11] The policy and the research suggest that if anything, immigrants put more into welfare programs than they take out.While immigrants are a source of cash flows to the federal government, they may constitute a fiscal burden for state and local governments. This is primarily because immigrants are poorer on average than U.S.-born taxpayers, and thus foot a smaller tax bill. A National Research Council study concluded that although immigrants are a fiscal positive to the federal government of about $105,000 over the course of their lifetime, they are a fiscal negative for state governments to the tune of $25,000.[12] However, the loss by state governments could be completely eliminated by the immigrants’ positive macroeconomic impact.The research is clear: the benefits of immigration greatly outweigh its small risks and miniscule negative consequences. Politicians often wrongfully paint immigrants as leeches wishing to enter our country to steal our jobs, lower our wages, and drain our welfare resources; these claims run counter to most economic evidence. We need to support candidates and policies that further liberalize immigration, not hamper it. When an immigrant comes to the United States, they not only better their own life, but the lives of their American neighbors.The Experts Agree Courtesy of the IGM Economic Experts Panel.Left Chart: “The average U.S. citizen would be better off if a larger number of highly educated foreign workers were legally allowed to immigrate to the U.S. each year.”[14]Right Chart: “The average U.S. citizen would be better off if a larger number of low-skilled foreign workers were legally allowed to enter the U.S. each year.”[13]Further Reading:Trillion-Dollar Bills on the SidewalkThe Case for Open BordersTen Economic Facts About Immigration16 Reasons Why Opening Our Borders Makes More Sense Than Militarizing Them

Courtesy of the IGM Economic Experts Panel.Left Chart: “The average U.S. citizen would be better off if a larger number of highly educated foreign workers were legally allowed to immigrate to the U.S. each year.”[14]Right Chart: “The average U.S. citizen would be better off if a larger number of low-skilled foreign workers were legally allowed to enter the U.S. each year.”[13]Further Reading:Trillion-Dollar Bills on the SidewalkThe Case for Open BordersTen Economic Facts About Immigration16 Reasons Why Opening Our Borders Makes More Sense Than Militarizing Them

- Staff, P. (16, July 21). Full text: Donald Trump 2016 RNC draft speech transcript. http://www.politico.com/story/2016/07/full-transcript-donald-trump-nomination-acceptance-speech-at-rnc-225974

- R. (2015, October 19). Anti-immigration party wins Swiss election in 'slide to the Right' http://www.telegraph.co.uk/news/worldnews/europe/switzerland/11939953/Anti-immigration-party-wins-Swiss-election-in-slide-to-the-Right.html

- France's National Front Claims Record-Breaking Victory. (2015, December 10). https://www.thetrumpet.com/article/13353.18.0.0/economy/frances-national-front-claims-record-breaking-victory

- Smith, L. (2016, January 13). The rise of the far-right in Poland: No more Eurovision, vegetarians or cyclists. http://www.ibtimes.co.uk/rise-far-right-poland-no-more-eurovision-vegetarians-cyclists-1537735

- Lerner, K. (2015, July 30). Why Immigration Is The Hole In Bernie Sanders' Progressive Agenda. https://thinkprogress.org/why-immigration-is-the-hole-in-bernie-sanders-progressive-agenda-604e5ce56e9f#.wblnhb8b1

- Foged, M., & Peri, G. (2013). Immigrants' and Native Workers: New Analysis on Longitudinal Data.

- Shierholz, H. (2010, February 4). Immigration and Wages: Methodological advancements confirm modest gains for native workers. http://www.epi.org/publication/bp255/

- Islam, A. (2007). Immigration Unemployment Relationship: The Evidence From Canada. Australian Economic Papers Aust Econ Papers, 46(1).

- Bier, D. (2016, July 26). Why Unemployment Is Lower When Immigration Is Higher

- Summary of Immigrant Eligibility Restrictions Under Current Law. (2009, February 25). https://aspe.hhs.gov/basic-report/summary-immigrant-eligibility-restrictions-under-current-law

- Zallman, L., Woolhandler, S., Himmelstein, D., Bor, D., & Mccormick, D. (2013). Immigrants Contributed An Estimated $115.2 Billion More To The Medicare Trust Fund Than They Took Out In 2002-09. Health Affairs, 32(6), 1153-1160.

- Griswold, D. (2012). Immigration and the Welfare State. Cato Journal, 32(1), 159-174

- High-Skilled Immigrants. (2013, February 12). http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_0JtSLKwzqNSfrAF

- Low Skill Immigrants. (2013, December 10). http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_5vuNnqkBeAMAfHv

The Optimal Bundle Fall Edition: Volume 21

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on NAFTA and globalization. Other topics covered are the first presidential debate, the ban-the-box movement, and Colombians’ vote to reject a peace agreement with FARC.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Summer Edition: Volume 20

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an op-ed on the Consumer Protection and Choice Act. Other topics covered are presidential candidates' opposition to the TPP, the acquisition of UberChina by homegrown DidiChuxing, and the recent decision by Britain's central bank to cut interest rates.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Summer Edition: Volume 19

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Committee.This volume of the Optimal Bundle features an analysis of gun control in the United States. Topics include the link between ownership and violent deaths, the human and financial impact of tighter regulation, and the gun lobby’s influence on Capitol Hill.

For an introduction to the issue, scroll down to read our previous blog post, “Good Guys and Bad Guys: The Trouble With Gun Control.”

Good Guys and Bad Guys: The Trouble With Gun Control

By Eleanor Tsai

Few issues are as loaded as gun control is in the United States today. Each mass shooting--frighteningly frequent within the past five years--is as divisive as it is painful: what can and should the government do to prevent deaths at the hands of would-be gunmen?Those on the left make impassioned calls on Congress to pass stricter laws regulating who can own guns. Among other proposals, they favor assault weapons bans and expanding and mandating background checks that would make it more difficult to buy weapons in the first place. Everyone is safer when there are fewer guns on the streets, the argument goes. Those on the right insist such restrictions would infringe on the Second Amendment rights of law-abiding gun owners, without commensurate efficacy in stopping gun violence. They point to the fact that killers often acquire their weapons illegally, rather than legally, and refer to a long-standing claim that more guns deters crime. In the words of Wayne LaPierre, the CEO and Executive Vice President of the National Rifle Association, “The only thing that stops a bad guy with a gun is a good guy with a gun.”Wayne LaPierre’s reasoning appeals to the old economic fallback of cost-benefit analysis. It suggests if a gunman believes he is able to act before law enforcement can respond or punish him, the risk and hence expected cost of the crime to him is lower relative to his payoff. However, if everyone else were to carry guns and be able to retaliate against him immediately after he opened fire, the risk of dying in the act would increase; and anticipating this, he would be more likely to refrain from shooting. Generalizing beyond the potential shooter implies game theoretic behavior--each person decides whether or not to carry a gun based on whether or not those around them do. If one person buys a gun, the others become vulnerable unless they, too, take up guns to signal they are credible threats and keep him from shooting. In equilibrium, no one will own a gun, or everyone will. The same logic has been applied in international relations theory to explain arms races between countries.It is hard to refute that a world without weapons is safer than a world in which everyone owns them. After all, even if all gun owners were mentally stable “good guys,” accidents could set off deadly shootings. But the reality is not, in fact, dichotomous; blanket assault weapons bans have been politically unfeasible, so across the country there are people who own guns and people who do not, and the prevalence of gun ownership varies considerably by community. While it is intuitive that in this case government regulation should focus on identifying and targeting likely killers, there are no “one-size-fits-all” policy prescriptions due to location-specific factors. For example, states have differentially adopted “shall-issue” laws, which stipulate that they must grant gun owners licenses to carry concealed weapons, as long as certain criteria are met (that is, no justification is required).Heterogeneity begs an examination of the empirical relationships between gun ownership, concealed carry, and public safety. Two papers have studied these issues directly: Duggan (2000) and Ayres and Donohue (2002). Duggan (2002) finds “increases in gun ownership lead to substantial increases in the overall homicide rate,” but have small or statistically insignificant effects on other types of crimes. Ayres and Donohue (2002) assert, “No longer can any plausible case be made on statistical grounds that shall-issue laws are likely to reduce crime for all or even most states.” What do you think? Given the theory and the data, should the United States increase limits on gun ownership? If so, how might shall-issue and other existing laws be reformed to draw closer to a social optimum that balances public safety with civil liberties?Further reading:CNN: Senate Rejects Gun Control MeasuresWashington Post: The Economics of Gun ControlCQ Researcher: Should Lawmakers Tighten Firearm Restrictions?The Social Cost of Gun Ownership (Cook & Ludwig, 2006)A Game Theoretic Model of Gun Control (Taylor, 1993)

The (International) Optimal Bundle Spring Edition: Volume 18

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the Panama Papers. Other topics in this edition include the impact of the commodities boom on South American economies, the Greek-Macedonian border's role in the global refugee crisis, and the simultaneous high economic growth forecast and struggles of Southeast Asia. This is an online version of the print edition of the Optimal Bundle.

The (Domestic) Optimal Bundle Spring Edition: Volume 17

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the U.S.'s role in funding NATO. Other topics in this edition include the revelations of the Panama Papers, a decline in U.S. retail sales, and Bernie Sanders' comments about General Electric. This is an online version of the print edition of the Optimal Bundle.

The (Domestic) Optimal Bundle Spring Edition: Volume 16

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about political inertia regarding the Pennsylvania state budget. Other topics in this edition include gridlock in the appointment of Supreme Court nominee Merrick Garland, the "fake CEO or President" scam, and the future of alternative intelligence. This is an online version of the print edition of the Optimal Bundle.