The Labor Shortage: What’s Causing It & How Long Will It Last?

We have all seen “Help Wanted” signs in the windows of our local grocery stores, fast food restaurants, and retailers, some offering higher wages and sign on bonuses. This past June the number of open jobs surpassed the number of those looking for work. The short answer as to why numerous companies are struggling to find workers is because of a labor supply shortage, meaning a large percentage of individuals who are eligible to work are choosing not to. Desperate to find applicants, companies are raising their wages in hopes it will attract supply, which would be illustrated as a movement to the right along the blue supply curve shown below. Considering the federal minimum wage has been stagnant for the past twelve years, one might assume the increasing wages provide a reasonable incentive to return to work. However, other influences in the economy are resulting in the labor shortage persisting for the past five months or so.

Typically, after a recession, consumers are hesitant to spend, companies are reluctant to hire, and workers are eager to find jobs, but as the United States is healing from the pandemic induced recession, these assumptions are the exact opposite. Consumption has been greatly increasing, companies are desperate for workers, and workers are choosing to stay home. A main contributor to the lack of individuals wanting to work is the way the pandemic has altered Americans’ routines and rearranged their minimum requirements. A common post-pandemic adaptation is the rising cost of childcare combined with a lower level of income; therefore, one parent is choosing to stay home to look after their children while the other parent works. The coronavirus also directly prevents individuals from working temporarily too. From June to September of 2021, the number of people who said they were unable work because they had Covid or were caring for someone with the virus rose by 2.5 million. Because of the number of coronavirus cases persisting, some workers are hesitant to return to work for health reasons, and other workers have decided to never return.

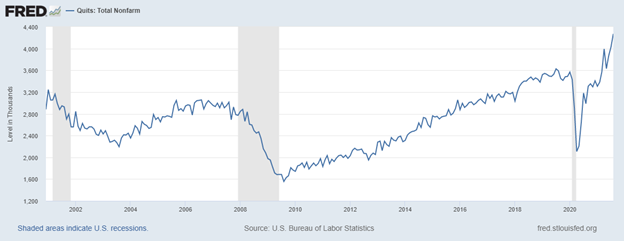

Because millions of workers were laid off or furloughed when the pandemic first hit, many baby boomers were forced into early retirement. In the third quarter of 2020, nearly 30 million baby boomers retired, and a recent survey reveals 75% of respondents say they plan to retire early. Some have plans to partake in gig jobs, such as Uber and Door Dash, but most have reevaluated what is most important to them and plan to now spend their time doing what they enjoy. Baby boomers aged 65 and older were also deemed as being an “at risk” population for Covid, therefore, increasing incentives for them to not return to work. Not only does early retirement add to the labor shortage, but the generations that are following baby boomers are not as strong in numbers due to declining birth rates. As we have been shifting away from dependence upon agriculture jobs and towards dependence upon technology and innovation, people are having less children. Fewer numbers in the succeeding generations results in lower numbers of workers available to fill jobs. On top of this, the quitting rate has hit a record high in August 2021 at 2.9%, or 4,270,000 as seen in the graphic below. This is informally being labeled as the “Great Resignation” as workers are leaving their jobs to find better pay, better flexibility, and better opportunities.

Along with forced retirement, worldwide shutdowns back in 2020 also resulted in travel restrictions and difficulty moving across borders. These restrictions with accumulated legal permanent resident applications are causing a decline in levels of migration. The United States saw a decline of 44%, the second largest decline after Canada. A lack of educated immigrants coming to the United States can be tied to the labor shortage as well. It is common for foreign born individuals to come to the United States with a master’s degree or PhD, as they are attracted to the high levels of innovation and job opportunities in specific cities, typically those that are oriented around technology like Seattle, San Francisco, and New York. An increase of highly innovative workers results in knowledge spillovers and an increase in the number of jobs for unskilled and undereducated workers. However, low levels of immigration make it difficult for the United States to take advantage of these positive externalities, thus leaving innovation stagnant and companies desperate for employees. As the world is now beginning to return to its pre-pandemic state, migration is beginning to pick up, making companies hopeful the labor shortage will begin to ease up.

A less concrete contribution to the labor shortage is the distribution of stimulus checks and unemployment insurance to qualifying individuals. Some economists claim this distribution of this aid money is incentivizing people to stay home rather than returning to work. However, other economists disagree as certain states withdrew from unemployment benefit programs early. But looking into the future, economists agree that the labor shortage is here to stay as the relationship between employers and employees has shifted after the pandemic. Rather than a company asking, “why should we hire you,” employees are now asking “what benefits are you able to provide me?” The recession itself has officially been over since April 2020, but the virus continues to impact individuals, companies, and the economy. The labor market may not begin to return to its normal state until the number of cases is virtually zero, eliminating the threat to workers’ health, but other factors like the declining birth rates may have longer lasting effects.

U.S. Economy Sees Disappointing Growth Rate

In Quarter 3 of 2021, the United States expected growth rate of GDP was projected to be around 2.7%. According to the recent report from the Bureau of Economic Analysis, the United States GDP in the third quarter was 23.17 trillion. That is a 2% increase in economic growth rate from the second quarter of 2021. These most recent figures of GDP rate suggest limited economic growth. What exactly is causing a lower than projected growth rate? Some economists claim the slow down in economic growth is the result of decreased consumer spending, supply chain issues, and an uncertain job market.

Consumer spending took a significant decline in the third quarter from the previous quarter. In quarter 2, consumer spending was high after increasing to 12% from the previous quarter. However, the consumer spending report was disappointing in the third quarter, where the growth rate was only 1.6%. These numbers are one of the biggest reasons economic growth was disappointing, as consumer spending makes up majority of the United States economy at roughly 69%.

The significant decrease in consumer spending is a result of decrease in personal disposable income among consumers. This most recent quarter revealed that there was a 0.7% in decline in personal disposable income. This decrease in disposable income this quarter has been consistent from the previous quarters after the ending of stimulus packages and additional unemployment insurance.

Supply chain concerns have been concerning globally among countries. In the United States, the supply chain issues are resulting from a lack of truck drivers. The shortage of truck drivers is causing a lag in supplies reaching individual firms. Elsewhere globally, the ports in countries like Germany and others are experiencing standstills or backlogs. The global supply chain concerns could only get worse according to some economists. The global economy will continue to see increases in demand which will only delay supply chain issues being resolved. Additionally, the supply side of the economy will be attempting to catch up with the significant increases in demand.

These supply chain concerns have impacted businesses behavior and were influential in the third quarter slow economic growth rate. Ever since the United States began economic recovery in April of 2020, each quarter experienced high periods of growth. However, the supply chain issues have affected and stalled further economic growth. With supply chain issues likely to continue, businesses will have to adjust to obtaining their products in order to continue growth.

The job market has remained uncertain for businesses which has been another factor for the decline in consumer spending as businesses have been forced to raise prices. With a worker shortage, businesses are forced to decide whether to raise prices or close on Sunday and Monday for example. Job growth in August and September show why quarter 3’s economic growth rate was disappointing. Only 235,000 jobs were added in August and only 194,000 jobs in the month of September. These poor job reports explain the decreased growth among consumers spending.

The job market remains uncertain for businesses despite the Government’s unemployment insurance ending in the month of September. Businesses may not be left with many choices if the job shortage continues. Businesses everywhere may decide to raise prices as a result of having to increase wages to hire workers. These raised prices will create inflation and could decrease consumer spending. Until the job market returns to pre-COVID-19 times, businesses will be faced with difficult decisions.

Although the third quarter saw a 2.0% growth rate in GDP, it was only .7% off its projected 2.7% growth rate. The United States economy has been growing at a high rate ever since the initial recession began and ended in March 2020-May 2020. In quarters 1 and 2 of 2021, the U.S. GDP increased at 6.3% and 6.7%.

Until the supply chain issues are resolved, and the job market becomes more certain, the United States actual GDP can reach potential GDP. The United States potential GDP is a GDP estimator if the pandemic never occurred. With the holiday season on the horizon and the delta variant becoming more manageable there is room for optimism. Consumer spending should increase in the fourth quarter. Additionally, more workers will return to the job market after the government’s boosted insurance benefits ended.

Deployment of AI Solutions in Investment Management

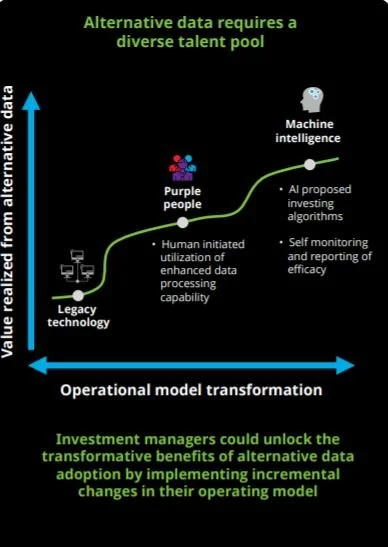

Within the current economic climate and market ecosystems, paradigms have and continue to shift towards markets that offer limited organic growth, high capital market volatility, and compression of fees and margin. As investment management firms internationally address these evolving conditions and formulate subsequent strategy, artificial intelligence (AI) has provided the frameworks and capibilities necessary for firms to navigate digital changes and maximize their operations.

Artificial intelligence collectively denotes the ability of machines to display and apply logical reasoning to particular environments and scenarios, autonomously determining outcomes similar to human-like intelligence without the use of hard-coded software algorithms that explicitly define the relationships and processes occurring. AI utilizes computer science techniques such as machine learning, reinforcement learning, and deep neural networks for capibilities like pattern recognition, future event anticipation, rule establishment, decision-making, and user communication.

The defined abilities of AI and potential applications of the technology provides firms in the investment management industry with the oppurtunity to deliver unprecedented value to their clients through model refinement, augmentation of human workforce intelligence, and technological advancements. The deployment and implementation of AI-centric solutions remains a key component in enabling the digital transformation of firms amidst changing market conditions and consumer attitudes. Additionally, AI initiatives at investment management firms contributes to driving efficiencies, innovation, and value creation, which align more closely with the present core focus on industrial AI applications.

The core focus of current enterprise AI applications has mostly emphasized operational improvements in front-to-back office functional processes. Implementation of these AI improvements in firm operations has resulted in frequent use cases for pattern recognition, trend analyses, and streamlining organizational processes. From these cases, firms can garner intelligent insight into their operations that supports sales and distribution, product pricing, portfolio construction, performance attribution, and customer experience optimization (among many others).

While these examples of frequent AI deployments in investment management firms will continue to be an important element of firm-AI integrations, AI use will advance to include additional applications that leverage cognitive technologies with AI in a multifaceted range of business functions across the industry value chain. This shift in future AI solutions is exemplified by BlackRock, the largest asset management firm in the world, which has created the BlackRock Lab for Artificial Intelligence.

Implementation of AI, machine learning, and other neural networks within firms in finance and investing justifiably raises concerns over the ethics of such usage, including outcomes, accountability, and governance amidst a slew of other possible issues. To effectively and ethically utilize AI tools to satisfy every-changing standards and conditions, Deloitte has identified four critical pillars for digital transformation with AI in investment management. This framework provides firms with the ability to make bold capital allocation decisions necessary to remain profitable within the global economy. A summary of these pillars is provided below:

Creating Alpha

Within the scope of investment management, alpha refers to a performance indicator of a trade, trading strategy, or portfolio composition has outperformed the market

The market portion of alpha is typicially quantified by the value of an all-encompassing index that is representative of market performance

The functional design of AI is conducive to incorporating modern big data and alternative data to provide investment management firms with the tools to derive organic growth

Operational Efficiency Improvements

Enhanced operations continues be an integral application of AI applications in business, playing a vital role in the continuous improvement strategy of a firm

Firms have an oppurtunity to capitalize upon their successful internal AI solutions:

Offering AI suite “as a service” for competitors or other markets

Product & Content Optimization

AI provides firms with the ability to develop a holistic comprehension of their various clientele and their preferences

Allows for effective content personalization

Increased agility of content and products

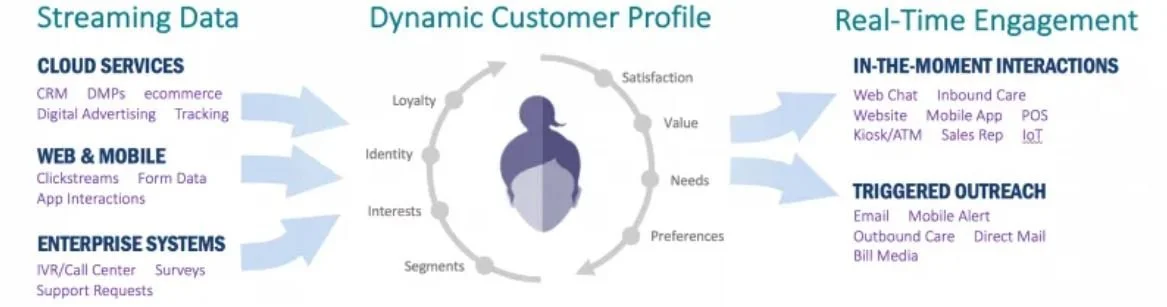

AI allows a firm to maximize CRM improvements through omnichannel segmentation, intelligent orchestration, customer data platforms, and other updated sources of truth

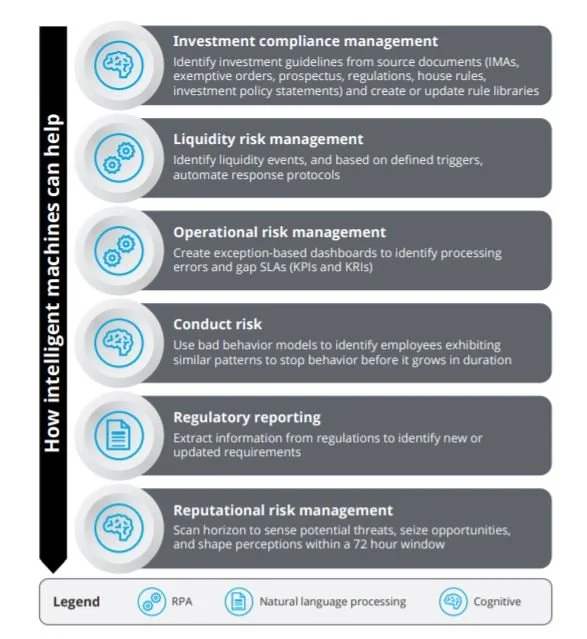

Risk Management

Fraud protection and risk computations will continue to grow as a core component of firm risk management strategy in investment management

Improved compliance, corporate strategy

Utilization of AI in risk management permits:

Data Analysis Automation

Decreased time on administrative activities

Firm employees spending more time on higher value-added tasks

These four pillars of transformation for AI in investment management help in constructing the necessary robust framework to deploy and implement AI solutions on the firm-level, but ultimate usage within a specific firm’s infrastructure will be dependent on the firm stakeholders’ technological attitude, the firm standard operating model, the firm core infrastructure and systems, and the firm talent acquisition.

As more and more investment management firms, along with businesses and organizations in every industry and specialty, develop their software, strategy, and deployment of AI solutions concurrently with blockchain, cloud, and other growing computer science tools, the need for a robust AI plan and process becomes increasingly apparent. To ensure deployment and implementation adds to business value, some recommended next steps for firms in investment banking interested in or planning on using AI are:

Planning for augmented workforces in the future as technical skills in this field become more desired

Ensuring AI software and tools converge with other firm systems and software

AI is not an isolated, standalone solution

Maximizing the impact of AI implementation by interlinking it with other technological initiatives

Blockchain

Cloud Computing

Thus, by assembling a comprehensive, detailed plan for AI implementation, integration, and continuity, investment management firms can realize the full potential that AI and similar machine learning technologies offer. With technological advancements having an ever-growing impact on consumer behavior and preferences, proper and ethical usage of these tools is as critical now as ever.

Article Sources

The Labor Shortage: What’s Causing It & How Long Will It Last?

Julia Kwitkowski

https://www.wsj.com/articles/labor-shortage-missing-workers-jobs-pay-raises-economy-11634224519

https://fred.stlouisfed.org/series/JTSQUL

Moretti, Enrico. New Geography of Jobs.

U.S. Economy Sees Disappointing Growth Rate

Joshua Mruk

https://tradingeconomics.com/united-states/gdp-growth

https://fred.stlouisfed.org/series/GDP

https://www.washingtonpost.com/business/2021/10/28/gdp-q3-economy-delta/

https://www.cnbc.com/2021/10/18/supply-chain-chaos-is-hitting-global-growth-and-could-get-worse.html

Deployment of AI Solutions in Investment Management

Colin Spellman

https://www.ibm.com/cloud/learn/what-is-artificial-intelligence

https://www.investopedia.com/terms/a/alpha.asp

https://www.pointillist.com/blog/role-of-ai-in-customer-experience/