By Joe Kearns

It was the best of times. It was the worst of times. Good news was bad news. Bad news was good news. By March 5, the U.S. unemployment rate had fallen to 5.5%. Though workers could rejoice at improved labor market conditions, there was one group of people that panicked upon learning this news: Wall Street. In fact, the Dow decreased by 279 points and the S&P 500 fell by 1.4% when the unemployment data was available to the public.

Surely, this was a mistake! How could improvements in the labor market and other parts of the U.S. economy possibly be bad news? The answer lies in investors’ expectations of changes in monetary policy.

“Given updated labor market conditions, we expect the probability of the Fed lifting policy rates in June is now 55%,” wrote BlackRock portfolio manager Rick Rieder.

Investors feared that good news would eventually bring an end to the Federal Reserve’s accommodative monetary policy that had been boosting the stock market. Since 2008, the Federal Reserve has held the federal funds rate between 0 and 0.25%. According to Investopedia, the federal funds rate is the “interest rate at which a depository institution lends funds maintained at the Federal Reserve to another depository institution overnight.” Keeping the federal funds rate near the zero bound has made it cheap for banks to borrow money from the Fed. In turn, consumers can borrow money from banks at low interest rates, which allows consumers to spend more and the stock market to rally. This is precisely what has happened in the U.S. economy, as the Dow Jones Industrial Average eclipsed 18,000 in December.

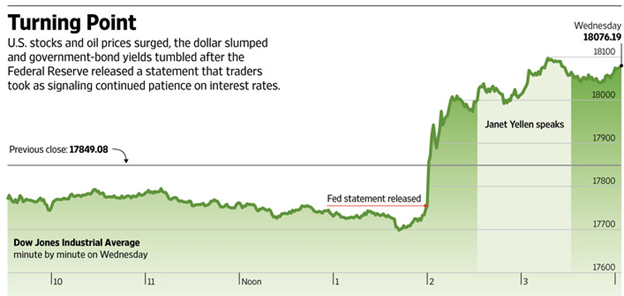

One word epitomized the anxiety of investors: patience. Previous FOMC Meeting Statements included a significant sentence: “Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” “Patient” came to an end on March 19—at least, in the sense that the FOMC Meeting Statement no longer included the word.

Yet, despite the exclusion of the word “patient,” stock prices surged. Among other comments in the statement, this one suggested the elimination of the word “patience” did not equate to a signal that the Fed would soon increase the federal funds rate target: “The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” Fed chairwoman Janet Yellen even remarked, “Just because we removed the word ‘patient’ from the statement doesn’t mean we are going to be impatient.”

The moral of the story is this: Don’t read too much into specific words. When it comes to predicting what the Fed will do next, let economic data speak for itself.

Sources

http://www.wsj.com/articles/investors-celebrate-gentler-tone-from-fed-officials-1426720774?mod=WSJ_hp_LEFTWhatsNewsCollectionhttp://money.cnn.com/2015/03/06/investing/stocks-market-jobs-fed-rate-hike/http://www.federalreserve.gov/newsevents/press/monetary/20150318a.htmhttp://www.nytimes.com/2015/03/19/upshot/janet-yellen-isnt-going-to-raise-interest-rates-until-shes-good-and-ready.html?_r=0&abt=0002&abg=1

http://www.federalreserve.gov/newsevents/press/monetary/20150128a.htm