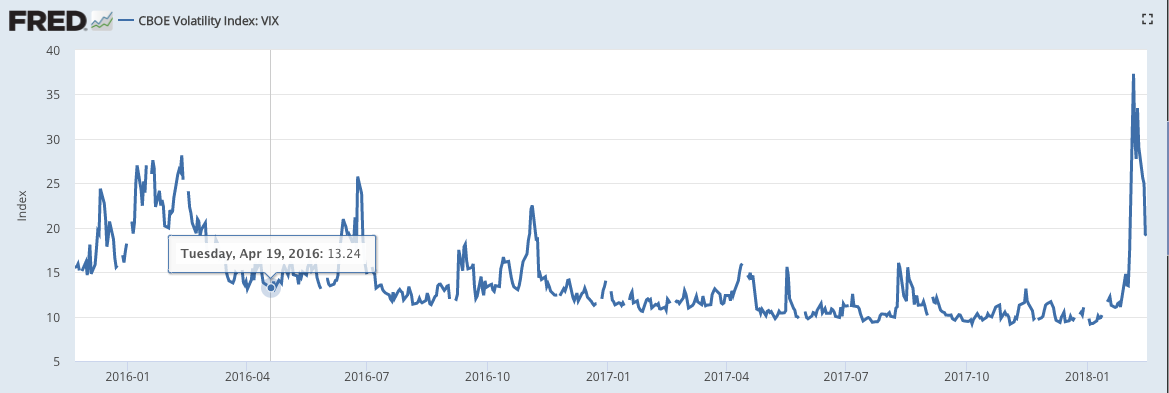

The Chicago-based volatility index attempts to give investors a tool to calculate impending fluctuations in the market.February 16, 2018By Patrick Reilly_______The CBOE Volatility Index, known by its ticker symbol, VIX is a tool that investors use to estimate fear in the marketplace. The VIX was created in 1993 through the Chicago Board of Trade and was the first way to measure volatility in the stock market.One way to think about it is that the VIX is like buying insurance. If you live in Florida and you hear that a hurricane is coming you’ll be willing to pay much more for insurance because there’s a higher chance that you’ll need insurance. You will pay more than you would normally.It’s very similar for investors if they’re afraid of a stock market crash, they’ll be willing to pay more for the VIX. The price level of the VIX is calculated using the price of put options on index funds. That sounds complicated but put options are just bets that the price of the stock market will go down. So if people think that a stock market crash is coming the price of the VIX will go up very quickly. Investing in the VIX implies that you’re anxious about the economy in the near future. However, over the last couple years, before this month, there wasn’t much to be anxious about.  The value of the VIX was steady at historically low levels of around 10 for several years. This led to the creation of the XIV, the inverse of the volatility index. Every time the value of the volatility index VIX increased, the price of XIV would decrease and vice versa. Investing in the XIV means that you were willing to bet that there wouldn’t be any hurricanes in the near future and that low volatility would continue. So over the last several years this was a good bet with steady income as the VIX fell consistently the price of the XIV increased consistently, until this month.

The value of the VIX was steady at historically low levels of around 10 for several years. This led to the creation of the XIV, the inverse of the volatility index. Every time the value of the volatility index VIX increased, the price of XIV would decrease and vice versa. Investing in the XIV means that you were willing to bet that there wouldn’t be any hurricanes in the near future and that low volatility would continue. So over the last several years this was a good bet with steady income as the VIX fell consistently the price of the XIV increased consistently, until this month.  Over the last year the price of the XIV was rising fast to a level over 100 until it crashed. In about two weeks the XIV lost 100% of it’s value and is no longer available for purchase.At the same time the price of the VIX rose to levels not seen since the 2008 financial crisis.Hopefully that all made sense but there’s one more wrench that was thrown into the equation. A whistleblower told regulators that there was a scheme to manipulate the VIX. Let’s say that you are a weatherman in Florida and own flood insurance and want to sell that flood insurance to someone else. You could go on TV and lie and say there are 10 category five hurricanes on their way and the value of your flood insurance would increase and you could sell at a profit.Similarly, if you could raise the price of the put options that the volatility index is priced off of then you would know that the price of the VIX will rise and the price of the XIV will fall. You could do this by raising fears of an impending stock market collapse or just buy the put options yourself and increase the demand and price. If you know the future prices of the VIX and XIV you could make a lot of money quite easily. The Chicago-based exchange denied the accusations but it does make sense to me at least in theory if you have enough money. The accusations are interesting and if proven would be a pretty brilliant money making scheme although illegal. On the other hand the price of the VIX could have just risen because there was a stock market correction happening. It’ll be interesting to see in the near future if there are any truth behind the allegations.___________Photo Credit: Modern Farmer Featured Image: The trading floor of the Chicago Board of Trade

Over the last year the price of the XIV was rising fast to a level over 100 until it crashed. In about two weeks the XIV lost 100% of it’s value and is no longer available for purchase.At the same time the price of the VIX rose to levels not seen since the 2008 financial crisis.Hopefully that all made sense but there’s one more wrench that was thrown into the equation. A whistleblower told regulators that there was a scheme to manipulate the VIX. Let’s say that you are a weatherman in Florida and own flood insurance and want to sell that flood insurance to someone else. You could go on TV and lie and say there are 10 category five hurricanes on their way and the value of your flood insurance would increase and you could sell at a profit.Similarly, if you could raise the price of the put options that the volatility index is priced off of then you would know that the price of the VIX will rise and the price of the XIV will fall. You could do this by raising fears of an impending stock market collapse or just buy the put options yourself and increase the demand and price. If you know the future prices of the VIX and XIV you could make a lot of money quite easily. The Chicago-based exchange denied the accusations but it does make sense to me at least in theory if you have enough money. The accusations are interesting and if proven would be a pretty brilliant money making scheme although illegal. On the other hand the price of the VIX could have just risen because there was a stock market correction happening. It’ll be interesting to see in the near future if there are any truth behind the allegations.___________Photo Credit: Modern Farmer Featured Image: The trading floor of the Chicago Board of Trade