In this joint blog post The Optimal Bundles takes a look at the causes, effects, and future of the U.S. - China trade war.

Editor: Zachary Shick

Authors by order of appearance: Natalie Desouza, Seth Estevis, Zachary Shick, Glenn Hubbard

In increasingly competitive basketball conferences, professional teams are looking to get an edge on analysis-based games. March 31, 2018By Peter Scharf_______It is Thursday March 30th and the opening day of the regular season for the Philadelphia Phillies and I am as least interested as I have been in years. Not because the Phillies are coming off a season where they posted one of the worst records in the league, not because most of the talent is not developed, and not because I have moved on to a win-now team. It is primarily because 1: Schoolwork in my final semester has slowly rotted away at my soul, 2: I have spent the last month or so taking my statistics skills into basketball, and 3: The Philadelphia 76ers are scorching the Earth that is the Eastern Conference. Basically, the Sixers, once the laughing stock of the NBA, have dominated and secured a playoff spot.With the Sixers advancing on analysis-based basketball and being snowed in at my Philadelphia home during Spring Break, I was inspired to build an NBA model that led to this post. To start, I will look into the game theory of basketball that the Sixers and a few other teams utilize.Maximizing Expected Shot ValueImagine a basketball court as some sort of weird matrix. Each area on the court has two components that go into the expected shot value, the worth of the shot and the percentage a shot from a certain area goes in. As a basketball player, or a coach coming up with a game plan, it would be desirable to shoot shots that maximize the expected shot value of a given situation.Up until the 1980 season in the NBA, the only way to do this was to get close to the basket. Big men dominated and much of the basketball action was closer to the rim. In 1980 things changed, the 3-point line was implemented. This made shots beyond its arc worth 0.5 times more than a standard shot.At first its usage was mainly as a gimmick.Today, teams are taking more threes than ever. As of this piece’s writing, the Houston Rockets are set to be the first team to ever take more threes than twos. The takeover of the three-point line has primarily been influenced by analytic based GMs and coaches maximizing expected shot value.Going back to the example of the basketball court matrix, the percentage of shots that go in decays the further you get away from the basket. Slam dunks, the closest shots, go in at near 100% clips. Long two’s and three’s dip under 50%. Basically, the further you get away from the basket the lower the percentage of shots that go in. This makes sense both statistically and in a “common sense” way. The further you are from the basket the harder it is for the ball to go in. Now, enter the three-point line.Although the league average on a 3-point shot is only 36%, the shot is worth 3 points and thus 3*.36=1.08 which is the expected shot value. Now imagine you are moving in towards the basket. Once you get inside 22 feet, you are no longer shooting a shot worth 3 points, however, the field goal percentage goes up.Shots from 15ft-22ft from the basket are worth two and go in 44% of the time. This leads to an expected shot value of 2*.44=.88, lower than taking a three. Moving even closer to the basket, the shot percentage goes up again. From 10ft-15ft out (approximately inside the distance from halfway to the foul line to the foul line), the field goal percentage climbs to nearly 50%.The expected shot value is approximately 1. Going on, 6ft-10ft’s expected shot value is 0.55*2=1.10, and under the basket to 6ft results in a 0.66*2= 1.32. Technically under the basket is only 0.82*2= 1.64. So, what happened here? Three-point shots are worth more than one expected point, and not until you get within the foul line are shots worth more than 1 expected point. Being that defenses make it more difficult to get to the basket, often times it is a best response to not dribble in towards the hoop, but rather step back and take a three.Across a season with 1000s of shots being taken, the law of averages sways in your favor. The dominant strategy ends up being a mixed strategy of taking shots underneath, in the in the red and blue zones, as well as beyond the three-point arc in the purple. The green and yellow are not best response shots because if you can not get the ball to the red or blue, you are better off passing it behind you and taking a three.So what does a game plan look like following this strategy? Basically, shooters are posted on the outside around the three-point line and a big man is posted up underneath the basket. The point guard brings the ball up and attempts to get the ball to the big man as shots under 10ft are worth 1.32+ and if that is unavailable, he passes to one of the shooters for an expected shot value of 1.08. Following this plan of maximizing expected shot value, the team should average over 100 points per possession. Here is what it looks like in action.This is a screenshot of the Sixer’s March 19 win over the Hornets.

So, what happened here? Three-point shots are worth more than one expected point, and not until you get within the foul line are shots worth more than 1 expected point. Being that defenses make it more difficult to get to the basket, often times it is a best response to not dribble in towards the hoop, but rather step back and take a three.Across a season with 1000s of shots being taken, the law of averages sways in your favor. The dominant strategy ends up being a mixed strategy of taking shots underneath, in the in the red and blue zones, as well as beyond the three-point arc in the purple. The green and yellow are not best response shots because if you can not get the ball to the red or blue, you are better off passing it behind you and taking a three.So what does a game plan look like following this strategy? Basically, shooters are posted on the outside around the three-point line and a big man is posted up underneath the basket. The point guard brings the ball up and attempts to get the ball to the big man as shots under 10ft are worth 1.32+ and if that is unavailable, he passes to one of the shooters for an expected shot value of 1.08. Following this plan of maximizing expected shot value, the team should average over 100 points per possession. Here is what it looks like in action.This is a screenshot of the Sixer’s March 19 win over the Hornets. The Sixers, in blue, have all their offensive scorers located in areas that maximize expected shot value. Dario Saric, the player just beyond the arc taking the shot, Robert Covington, Saric’s left, and JJ Reddick, far corner, are all ready shooters with a high expected shot value because they are beyond the three. In this specific case, Saric, Reddick, and Covington are elite shooters and all shoot above 40% from three making their expected shot value 0.40*3=1.2. The other Sixer, Amir Johnson, is directly underneath the basket anticipating a pass or a rebound for another shot with a high expected value. The only Sixer not in a maximized space is Ben Simmons who brought the ball up to the foul line then turned around a passed it to Saric because the expected value of a foul line shot from Simmons is less than a Saric three.Philadelphia 76er’s former GM Sam Hinkie realized this as well. When selecting players in the draft or through transactions with other teams, he picked either big men or shooters. The plan was to run a maximized offense for the next 10 years. While Sam Hinkie is no longer GM of the Philadelphia 76ers, his selected shooters in Robert Covington and Dario Saric as well as big men in Joel Embiid and Richaun Holmes continue to run this analytic based offense.

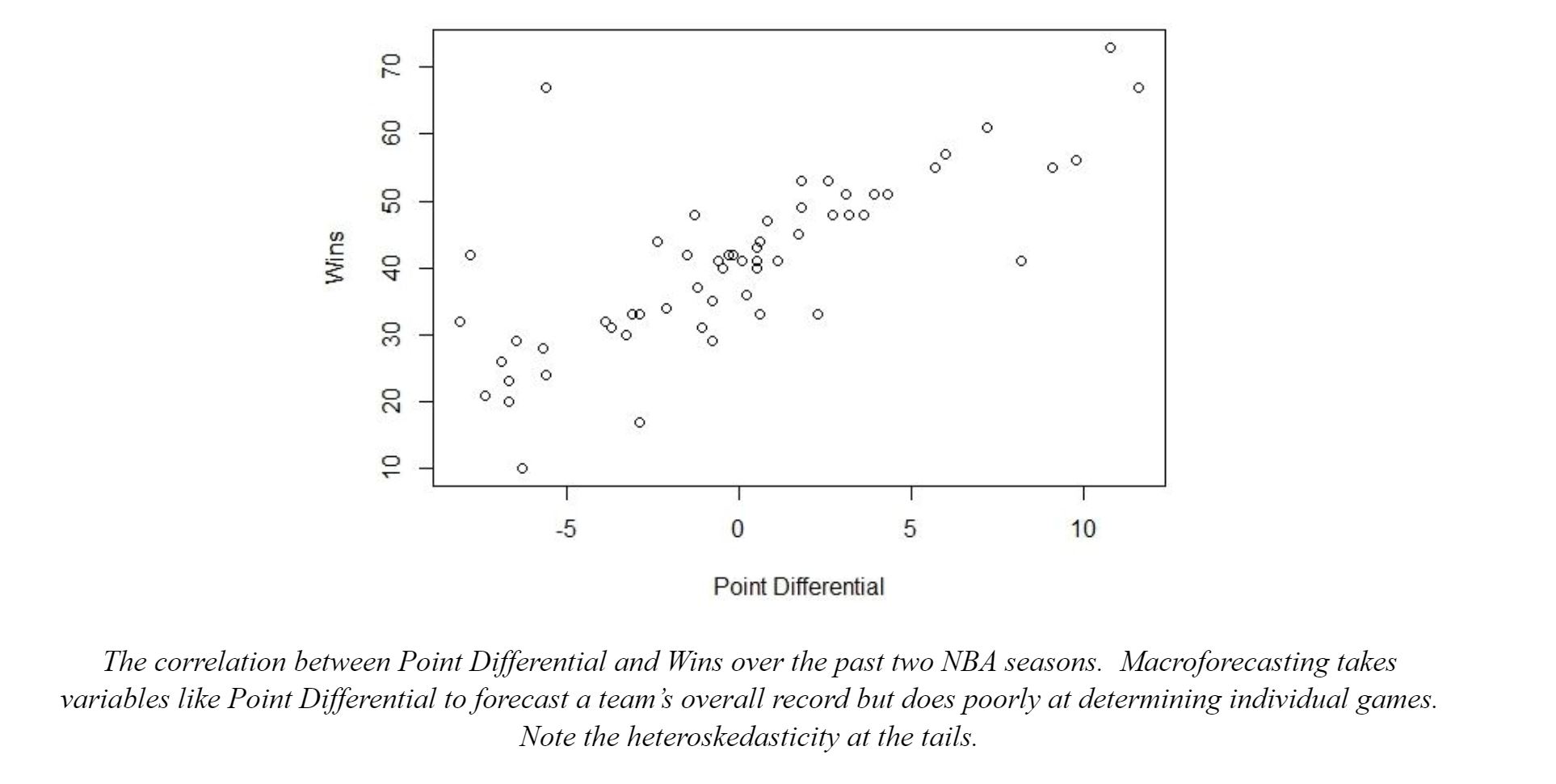

The Sixers, in blue, have all their offensive scorers located in areas that maximize expected shot value. Dario Saric, the player just beyond the arc taking the shot, Robert Covington, Saric’s left, and JJ Reddick, far corner, are all ready shooters with a high expected shot value because they are beyond the three. In this specific case, Saric, Reddick, and Covington are elite shooters and all shoot above 40% from three making their expected shot value 0.40*3=1.2. The other Sixer, Amir Johnson, is directly underneath the basket anticipating a pass or a rebound for another shot with a high expected value. The only Sixer not in a maximized space is Ben Simmons who brought the ball up to the foul line then turned around a passed it to Saric because the expected value of a foul line shot from Simmons is less than a Saric three.Philadelphia 76er’s former GM Sam Hinkie realized this as well. When selecting players in the draft or through transactions with other teams, he picked either big men or shooters. The plan was to run a maximized offense for the next 10 years. While Sam Hinkie is no longer GM of the Philadelphia 76ers, his selected shooters in Robert Covington and Dario Saric as well as big men in Joel Embiid and Richaun Holmes continue to run this analytic based offense. Former Sixers GM Sam Hinkie talks with a young Joel Embiid shortly after his drafting. Using Econometrics to Forecast Basketball Games (and doing well)As evident by the fact that his name gets dropped in nearly every one of my blogs, I am a huge admirer of Nate Silver. Particularly how he takes economics and statistics and applies them to areas typically outside the field. In the area of sports, Nate Silver has shifted forecasting away from betting lines and ESPN “analysts” and more towards a quantitative and probabilistic approach. I figured if Nate Silver can do it, I can get close.Basketball seemed like the easiest sport to start forecasting. Looking at the top records in the league shows that the best teams generally win 70%-80% of their games. Compare this to a sport like baseball where teams are more even and the best team only wins 63% of their games. So essentially, basketball has more skill involved and less randomness, more signal to capture and less noise.At my aid are my new-found skills in R and enrollment in ECON483 Economic Forecasting (I highly recommend taking this course). I spent the first few days of my Spring Break gathering data and crunching numbers. Looking for patterns between wins, points and general basketball statistics. I began to diverge into two types of basketball forecasting, macroforecasting and microforecasting. Macroforecasting pertains to season long play. How many wins will the team have? Where will they place in their conference? Which team will score the most points this season? Macroforecasting does this very well.

Former Sixers GM Sam Hinkie talks with a young Joel Embiid shortly after his drafting. Using Econometrics to Forecast Basketball Games (and doing well)As evident by the fact that his name gets dropped in nearly every one of my blogs, I am a huge admirer of Nate Silver. Particularly how he takes economics and statistics and applies them to areas typically outside the field. In the area of sports, Nate Silver has shifted forecasting away from betting lines and ESPN “analysts” and more towards a quantitative and probabilistic approach. I figured if Nate Silver can do it, I can get close.Basketball seemed like the easiest sport to start forecasting. Looking at the top records in the league shows that the best teams generally win 70%-80% of their games. Compare this to a sport like baseball where teams are more even and the best team only wins 63% of their games. So essentially, basketball has more skill involved and less randomness, more signal to capture and less noise.At my aid are my new-found skills in R and enrollment in ECON483 Economic Forecasting (I highly recommend taking this course). I spent the first few days of my Spring Break gathering data and crunching numbers. Looking for patterns between wins, points and general basketball statistics. I began to diverge into two types of basketball forecasting, macroforecasting and microforecasting. Macroforecasting pertains to season long play. How many wins will the team have? Where will they place in their conference? Which team will score the most points this season? Macroforecasting does this very well. For individual games, the macroforecasting approach was not effective. I realized this when I was explaining my research to a friend and he responded “Who cares?, I just want to know who wins tonight!” .For game-by-game forecasting I needed to explore the microforecasting approach. This approach looks at the scoring and defense of the two teams in a game and determines in outcome, this approach ends up being much more difficult.To model an individual game, be careful about what stats you use. Player stats are often measured in three different ways: per game, per 100 possessions, and per 36 minutes. It is important to focus on per game stats. Per possession and per minute stats are better on player specific statistics but on a whole team they are a poor measure. Remember, every team only control the pace when they are on offense. Stats like offensive efficiency and defensive efficiency can be skewed by fast or slow offenses in an actual game format.My microforecasting model continues to be refined but it looks something like this:The result of the game is Yv - Yh where Y is the predicted points for each team. If this number is positive, the visitor wins. If it is negative it is a home victory. Y is composed of:

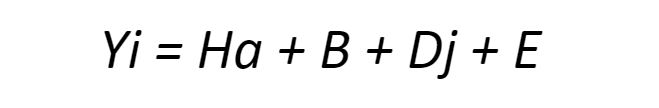

For individual games, the macroforecasting approach was not effective. I realized this when I was explaining my research to a friend and he responded “Who cares?, I just want to know who wins tonight!” .For game-by-game forecasting I needed to explore the microforecasting approach. This approach looks at the scoring and defense of the two teams in a game and determines in outcome, this approach ends up being much more difficult.To model an individual game, be careful about what stats you use. Player stats are often measured in three different ways: per game, per 100 possessions, and per 36 minutes. It is important to focus on per game stats. Per possession and per minute stats are better on player specific statistics but on a whole team they are a poor measure. Remember, every team only control the pace when they are on offense. Stats like offensive efficiency and defensive efficiency can be skewed by fast or slow offenses in an actual game format.My microforecasting model continues to be refined but it looks something like this:The result of the game is Yv - Yh where Y is the predicted points for each team. If this number is positive, the visitor wins. If it is negative it is a home victory. Y is composed of: Where y is the predicted points, Ha is a dummy (binary) variable that is activate for the home team because across 2056 games a clear home field advantage was observed, B is an adjusted average of points scored per game, Dj is the defense added points of the opposition (good defenses this number is negative because they take away and bad defenses have this as a positive number. This number can also be influenced by how fast the opposing team’s offense runs.), and E is an error term. Numbers get rounded down to whole numbers because you cannot score half points in basketball. My actual running model is of course more complicated than this, but this equation accounts for most of it.As an example, let's use the Friday March 30th, 2018 7:30PM game with the Philadelphia 76ers facing off against the Atlanta Hawks. The Sixers forecasted score is:

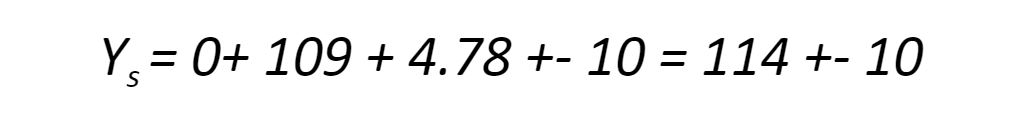

Where y is the predicted points, Ha is a dummy (binary) variable that is activate for the home team because across 2056 games a clear home field advantage was observed, B is an adjusted average of points scored per game, Dj is the defense added points of the opposition (good defenses this number is negative because they take away and bad defenses have this as a positive number. This number can also be influenced by how fast the opposing team’s offense runs.), and E is an error term. Numbers get rounded down to whole numbers because you cannot score half points in basketball. My actual running model is of course more complicated than this, but this equation accounts for most of it.As an example, let's use the Friday March 30th, 2018 7:30PM game with the Philadelphia 76ers facing off against the Atlanta Hawks. The Sixers forecasted score is: For the Hawks it is:

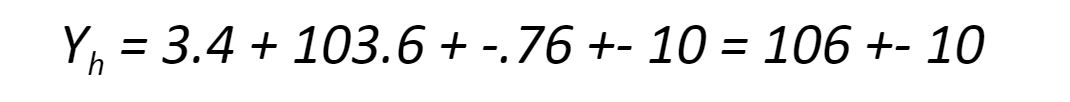

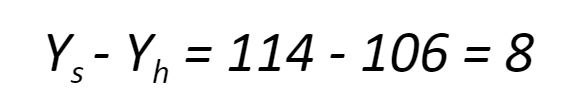

For the Hawks it is: Thus, the forecasted result is:

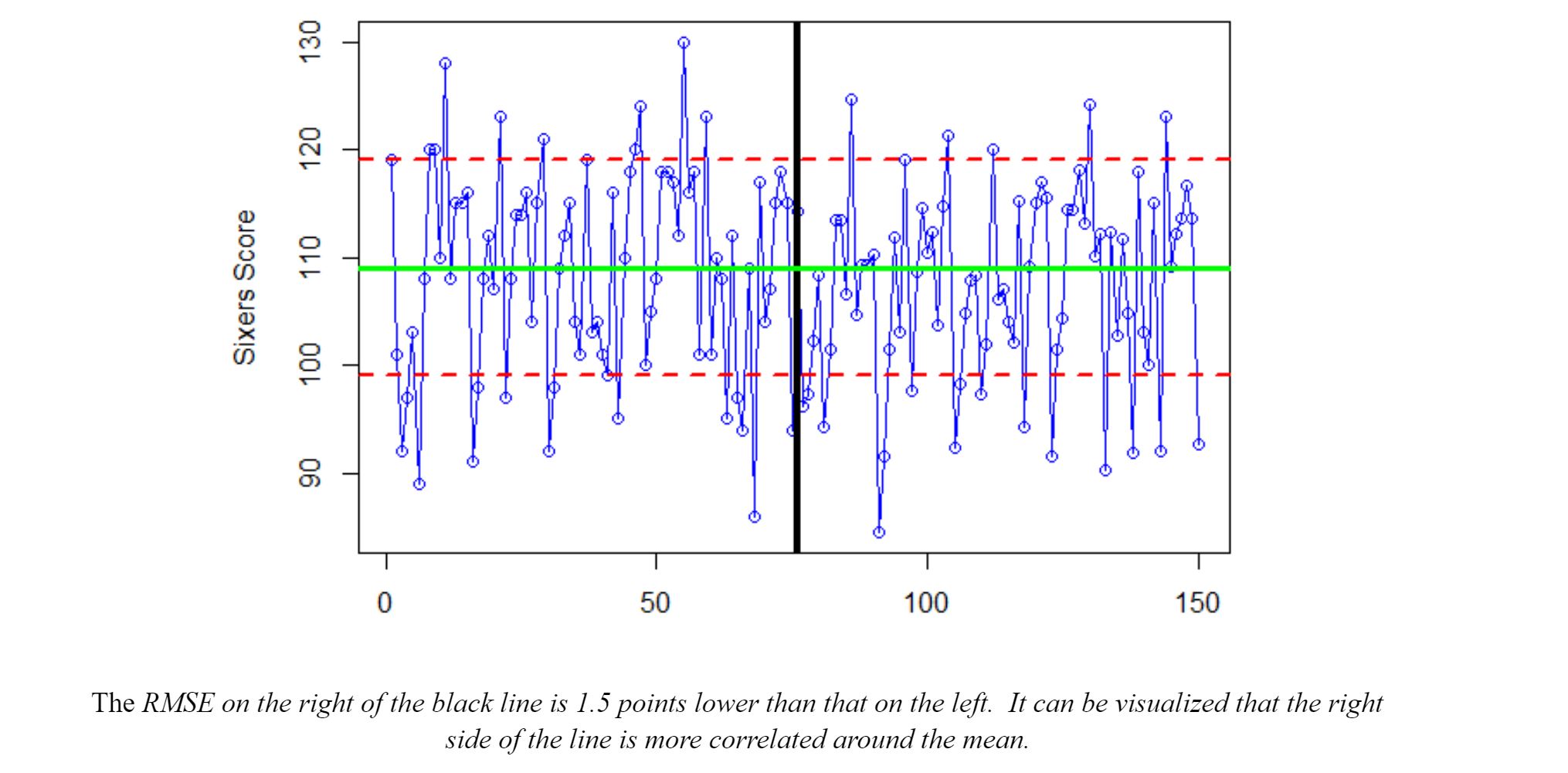

Thus, the forecasted result is: The model forecasts a Sixers, the visiting team, victory by plus 8. The actual game was much lower scoring than anticipated, particularly because the Sixers played their worst players in the 4th quarter to rest the starters for the playoffs, and the final score was 101-91. The Sixers won by 10 and the residual between the forecast and the actual score is -2. Although not perfect, sports are volatile and getting this close is impressive.To run this regression in programs like STATA and R, treat opposing defenses like seasonality. This will treat the opposing defenses like dummy variables and apply them when the team name is equal to a certain character value. To visualize the effect of opponent defense on score look at the plot below. It is the 76ers scores for each game plotted twice, to the left of the black line for unadjusted and to the right for adjusted. The red dashed lines are at 119 and 99 (within one standard deviation) and the green line is the Sixer’s B of 109. Although slightly, the right side of the black line is more correlated around the mean.

The model forecasts a Sixers, the visiting team, victory by plus 8. The actual game was much lower scoring than anticipated, particularly because the Sixers played their worst players in the 4th quarter to rest the starters for the playoffs, and the final score was 101-91. The Sixers won by 10 and the residual between the forecast and the actual score is -2. Although not perfect, sports are volatile and getting this close is impressive.To run this regression in programs like STATA and R, treat opposing defenses like seasonality. This will treat the opposing defenses like dummy variables and apply them when the team name is equal to a certain character value. To visualize the effect of opponent defense on score look at the plot below. It is the 76ers scores for each game plotted twice, to the left of the black line for unadjusted and to the right for adjusted. The red dashed lines are at 119 and 99 (within one standard deviation) and the green line is the Sixer’s B of 109. Although slightly, the right side of the black line is more correlated around the mean. As a sports fan, using the stat and game theory skills I picked up in the classroom through the B.S. in Economics allows me to get involved with the game. I have become a more informed fan, despite only watching half of my home team’s games. I encourage anyone to apply statistics to an interest of theirs, it is surprisingly fun and gives new insights into that field._______ Author's Note: All statistical data comes from basketballreference.com All analysis and graphing was done using R within Rstudio or Microsoft Excel. For more information contact optimalbundle.psuea@psu.edu. Editor's Note: Minor changes have been made to the original version of this piece. Feature Image Credit: Public Domain

As a sports fan, using the stat and game theory skills I picked up in the classroom through the B.S. in Economics allows me to get involved with the game. I have become a more informed fan, despite only watching half of my home team’s games. I encourage anyone to apply statistics to an interest of theirs, it is surprisingly fun and gives new insights into that field._______ Author's Note: All statistical data comes from basketballreference.com All analysis and graphing was done using R within Rstudio or Microsoft Excel. For more information contact optimalbundle.psuea@psu.edu. Editor's Note: Minor changes have been made to the original version of this piece. Feature Image Credit: Public Domain

A lucrative but geographically challenging market is the battleground for some of the Commonwealth's largest health networks. March 7, 2018By Nicolas Guerrero_____

In the years following the implementation of the Affordable Care Act, its provisions and resulting cost increases led to a series of reconfigurations in healthcare markets across the country. Pennsylvania is a market where healthcare providers and insurers have found a particular need for steadfast consolidation.

Three entities dominate a geographically challenging, yet lucrative healthcare market. The University of Pittsburgh Medical Center (UPMC) is the largest non-governmental employer in Pennsylvania. Headquartered in downtown Pittsburgh, UPMC operates over thirty hospitals in the western and central regions of the state. In addition, UPMC Insurance Services covers over 3.4 million members.

Penn State Health operates the flagship Milton S. Hershey Medical Center, Children’s Hospital and Cancer institute in Hershey, the Penn State Health St. Joseph Hospital in Reading, and 120 medical offices across the Commonwealth. Generating between $1.3 and $1.5 billion in annual revenue, Penn State Health is a major health system and its flagship hospital is the largest in the Greater Harrisburg region.

The University of Pennsylvania Health System, Penn Medicine is the state’s second most lucrative network after UPMC generating around $5.3 billion in annual revenue and operates six hospitals and eight multispecialty facilities along the eastern flank of the state.

The urban markets of Philadelphia and Pittsburgh are separated by 300 miles of vast, sparsely populated rural countryside where medical facilities are likely operated by a dominant regional health system.

In March 2015, the Penn State Milton S. Hershey Medical Center completed plans to merge with PinnacleHealth System, the other dominant healthcare provider in the Harrisburg area. Together, both entities would operate as a single network providing health services for Dauphin County and surrounding markets. In December of that year, The Federal Trade Commission (FTC) filed a lawsuit halting any further action and requesting further information. The FTC, along with the Pennsylvania Office of the Attorney General argued that such merger would create a regional monopoly, increasing prices and potentially lowering quality for the South-Central Pennsylvania market. Yet markets are ambiguous and difficult to make out with naked perceptions.

This particular point was made by the United States District Court, which argued that the FTC had failed to define which specific markets would be harmed by the merger. For horizontal mergers, such as the one between Penn State Hershey and PinnacleHealth—where both merging entities are within the same or similar industry—federal anti-trust authorities apply the hypothetical monopolist test to clearly define such market. In this test, the relevant geographic market is the smallest area in which a single firm could raise prices without consumers resorting to firms outside the region to avoid such a price increase.

The Harvard Law Review notes that District Court found that the FTC had not adequately defined the relevant market as the four-county area around Harrisburg, and “that 43.5% of Penn State Hershey’s patients travel to the hospital from outside of the region, suggesting that the FTC’s proposed market failed to properly account for where the hospitals draw their business”. When the Third Circuit Court of Appeals reversed the District Court’s decision, Penn State spent $17 million on legal arguments in an unsuccessful attempt to push for the merger. The motivation behind the Penn State Hershey-PinnacleHealth merger focused on the benefits by scale economies in a market perceived as underserved by University officials and Pinnacle executives. The 64% market share that both entities would have represented in the region was to be transitory, as equally large health “megasystems” such UPMC and Penn Medicine were quickly expanding into the central Pennsylvania market.

Penn State Hershey CEO Craig Hillemeier argues that with Penn State Hershey operating at near full capacity, the merger would have given the medical campus the size and efficiencies required to compete with entering firms without sacrificing patient care. According to both entities, merging the firms would have led to decreased operating costs, increased flexibility in transferring patients to other hospital locations, lower construction costs, and lower costs for patients on a case-by-case basis. The Penn State University Board Trustees dropped all litigation efforts the following year. The projected legal costs coming out of University coffers outweighed the benefits of completing what seemed to be a lengthy merger process.

PinnacleHealth already searching for capital, immediately shifted its focus to its next potential partner. In 2017 PinnacleHealth successfully merged with UPMC, further consolidating Pennsylvania’s largest health system. As predicted, the newly created UPMCPinnalce expanded quickly, operating 12 hospitals in ten counties across central Pennsylvania.

PinnacleHealth already searching for capital, immediately shifted its focus to its next potential partner. In 2017 PinnacleHealth successfully merged with UPMC, further consolidating Pennsylvania’s largest health system. As predicted, the newly created UPMCPinnalce expanded quickly, operating 12 hospitals in ten counties across central Pennsylvania.

Expanding in this region is cost-effective for a behemoth like UPMC, where operating costs for existing hospitals and construction costs for new ones are relatively low. Some of these regional hospitals have between ten and sixty beds and serve markets that no other healthcare provider would likely find economic sense in entering.

Lancaster General Health was acquired by Penn Medicine in 2015. This westward encroachment by a Philadelphia-based firm alerted UPMC and Penn State Health, as the fragile central Pennsylvania market has relatively fixed demand. This contributed to Penn State’s increased “megasystems” competition argument during federal litigation. Should Penn Medicine seek to expand beyond Greater Philadelphia, it will add more pressure to competing health systems, and find several health networks already setting their eyes on the lucrative region. That is what UPMC discovered and successfully tackled when it expanded eastward of Pittsburgh. Penn Medicine has the financial resources and acclaimed reputation to be just as successful.

With health systems quickly growing across the Commonwealth, Penn State Health sought to find a partner that would be reputable and profitable in the face of aggressive competition. After the failed attempt to merge with PinnacleHealth, university resources had to be used carefully, objectives had to be clear, and litigation avoided if possible. Without being neither a merger nor acquisition, Penn State Health partnered with Highmark, the largest insurance provider in the state.

Under this agreement, Highmark ends its partnership with UPMC, and gives an infusion of capital to Penn State Health, allowing it to build new hospitals and facilities to directly compete for UPMC’s consumers. $1 billion will be used to update and expand Penn State Health operations. In exchange, Highmark will send its members to the Penn State Health system hospitals and physicians. The insurer now has three seats on Penn State Health’s fifteen-person board. Thus, Highmark becomes a healthcare insurer and provider through this partnership, just like UPMC.

___________ Featured Image: The Susquehanna River flows through central Pennsylvania Image Credit: Pubic Domain

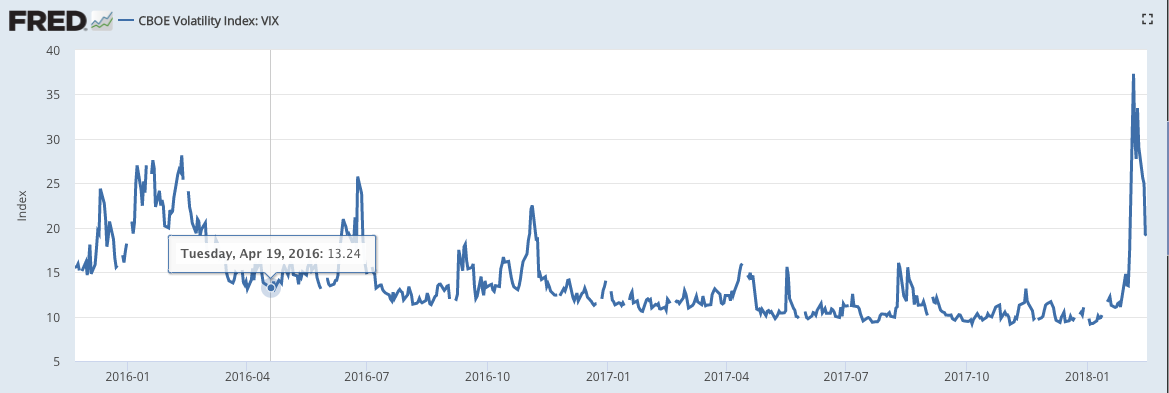

The Chicago-based volatility index attempts to give investors a tool to calculate impending fluctuations in the market.February 16, 2018By Patrick Reilly_______The CBOE Volatility Index, known by its ticker symbol, VIX is a tool that investors use to estimate fear in the marketplace. The VIX was created in 1993 through the Chicago Board of Trade and was the first way to measure volatility in the stock market.One way to think about it is that the VIX is like buying insurance. If you live in Florida and you hear that a hurricane is coming you’ll be willing to pay much more for insurance because there’s a higher chance that you’ll need insurance. You will pay more than you would normally.It’s very similar for investors if they’re afraid of a stock market crash, they’ll be willing to pay more for the VIX. The price level of the VIX is calculated using the price of put options on index funds. That sounds complicated but put options are just bets that the price of the stock market will go down. So if people think that a stock market crash is coming the price of the VIX will go up very quickly. Investing in the VIX implies that you’re anxious about the economy in the near future. However, over the last couple years, before this month, there wasn’t much to be anxious about.  The value of the VIX was steady at historically low levels of around 10 for several years. This led to the creation of the XIV, the inverse of the volatility index. Every time the value of the volatility index VIX increased, the price of XIV would decrease and vice versa. Investing in the XIV means that you were willing to bet that there wouldn’t be any hurricanes in the near future and that low volatility would continue. So over the last several years this was a good bet with steady income as the VIX fell consistently the price of the XIV increased consistently, until this month.

The value of the VIX was steady at historically low levels of around 10 for several years. This led to the creation of the XIV, the inverse of the volatility index. Every time the value of the volatility index VIX increased, the price of XIV would decrease and vice versa. Investing in the XIV means that you were willing to bet that there wouldn’t be any hurricanes in the near future and that low volatility would continue. So over the last several years this was a good bet with steady income as the VIX fell consistently the price of the XIV increased consistently, until this month.  Over the last year the price of the XIV was rising fast to a level over 100 until it crashed. In about two weeks the XIV lost 100% of it’s value and is no longer available for purchase.At the same time the price of the VIX rose to levels not seen since the 2008 financial crisis.Hopefully that all made sense but there’s one more wrench that was thrown into the equation. A whistleblower told regulators that there was a scheme to manipulate the VIX. Let’s say that you are a weatherman in Florida and own flood insurance and want to sell that flood insurance to someone else. You could go on TV and lie and say there are 10 category five hurricanes on their way and the value of your flood insurance would increase and you could sell at a profit.Similarly, if you could raise the price of the put options that the volatility index is priced off of then you would know that the price of the VIX will rise and the price of the XIV will fall. You could do this by raising fears of an impending stock market collapse or just buy the put options yourself and increase the demand and price. If you know the future prices of the VIX and XIV you could make a lot of money quite easily. The Chicago-based exchange denied the accusations but it does make sense to me at least in theory if you have enough money. The accusations are interesting and if proven would be a pretty brilliant money making scheme although illegal. On the other hand the price of the VIX could have just risen because there was a stock market correction happening. It’ll be interesting to see in the near future if there are any truth behind the allegations.___________Photo Credit: Modern Farmer Featured Image: The trading floor of the Chicago Board of Trade

Over the last year the price of the XIV was rising fast to a level over 100 until it crashed. In about two weeks the XIV lost 100% of it’s value and is no longer available for purchase.At the same time the price of the VIX rose to levels not seen since the 2008 financial crisis.Hopefully that all made sense but there’s one more wrench that was thrown into the equation. A whistleblower told regulators that there was a scheme to manipulate the VIX. Let’s say that you are a weatherman in Florida and own flood insurance and want to sell that flood insurance to someone else. You could go on TV and lie and say there are 10 category five hurricanes on their way and the value of your flood insurance would increase and you could sell at a profit.Similarly, if you could raise the price of the put options that the volatility index is priced off of then you would know that the price of the VIX will rise and the price of the XIV will fall. You could do this by raising fears of an impending stock market collapse or just buy the put options yourself and increase the demand and price. If you know the future prices of the VIX and XIV you could make a lot of money quite easily. The Chicago-based exchange denied the accusations but it does make sense to me at least in theory if you have enough money. The accusations are interesting and if proven would be a pretty brilliant money making scheme although illegal. On the other hand the price of the VIX could have just risen because there was a stock market correction happening. It’ll be interesting to see in the near future if there are any truth behind the allegations.___________Photo Credit: Modern Farmer Featured Image: The trading floor of the Chicago Board of Trade

As online retail giant Amazon narrows its quest to find a location for its second headquarters, local governments across North America are testing the limits of economic incentives.February 2, 2018By Avery Ryan_______Within the past few months, The race to host Amazon’s headquarters has intensified and is now boiled down to a list of twenty cities still in the running. Earlier in January, Amazon released a list of finalists, which identified the 20 out of the 238 bids from across North America that were still being considered for hosting the new headquarters. These finalists are Philadelphia, Boston, Toronto, Atlanta, New York, Washington, Miami, among others. The reason behind the fierce competition lies in the opportunities that hosting operations for a company such as Amazon would bring for a city and surrounding metro area.Being the location of Amazon's headquarters bring a long list of benefits. As many as 50,000 new jobs would be created. The winning city would receive great publicity as well. Overall, acquiring Amazon’s headquarters is most American mayor’s dream come true.However, the race has turned quite serious in the past few weeks. Cities are going to extremes in order to get Amazon’s pick, and it may be doing more harm than good. Cities have offered billions of dollars in tax subsidies in order to attract the firm. Amazon CEO, Jeff Bezos, is operating this deal with a degree of secrecy, making it harder for city leaders to figure out how to best win over the $675 billion company. For example, New Jersey has offered $7 billion in tax-breaks for Amazon if it chooses Newark for the new headquarters. While Amazon's entry will bring more revenue and jobs, the city will have to take other risks into consideration. They must consider widening roads, hiring more teachers, and building more housing. The cost of all of these upgrades, according to the Washington Post, is going to fall on residents and small business owners of the city. Residents who will have to pay more in a state with already high tax levels may not be as willing to jump on board. Small and mid-size businesses will have to play a role in the repayment of these tax subsidies. Smaller firms, with Amazon being an unrivaled behemoth, will not be pleased that their tax dollars will be supporting their competition.An interesting deal may arise in the greater Washington, D.C. area, where 3 of the finalist cities are located. Muriel Bowser, the mayor of Washington, D.C. made a statement regarding how the headquarters of a company of such size would equally benefit her city, Northern Virginia, or Montgomery County, Maryland. Economists, along with public policy experts, agree that these three finalist cities should collaborate in order to convince Amazon to come to any of the three cities.PrecedentsThis race for a facility to be placed in a city in order to gain revenue and improve standard of living is nothing new. Sports franchises cause the same kind of competition between cities due to the enormous amount of revenue generated in this business. Cities will fight to acquire sports franchises, and sometimes are forced to spend large sums of money just to keep them in the city. Similarly to the Amazon situation, economists question whether or not this decision by city leaders is more helpful or harmful.Brad. R. Humphreys, an economics professor at West Virginia University , researches the economics of professional sports. In a piece for the Regional Science and Urban Economics Journal, Humphreys wrote about a change in viewpoint about the benefits of tax subsidies for the purpose of sports franchises. Between 1950 and 2010, an estimated $59 billion in 2006 dollars were spent on the building of sports facilities in the United States. Humphreys notes that the business done inside these stadiums is entirely private enterprise and the revenues generated from private sporting events are split between the employees, players, and owners. There are not many other private profit-generating firms that receive such large amounts of tax subsidies. Humphreys suggests that while it has been said that these facilities increase jobs, create higher incomes, and increase tax revenues in the past, that may not be the case anymore.Proponents of sports facilities are now justifying the subsidies with urban redevelopment. The bulk of this journal analyzes a spatial model that suggests that cities are giving out subsidies to these sports franchises despite the lack of evidence that the construction of these sports facilities create fiscal benefits for a local economy.The similarities between sports franchises and Amazon’s headquarters bring up an interesting question for cities that are still in the running for Jeff Bezos’ competition. Providing such large subsidies may be guiding cities in the wrong direction. However, the race is still on and the cities are still pushing. Whichever city finishes in first place will be the new home of Amazon’s second headquarters, and will experience the externalities--both positive and negative--of experimenting with incentives of such magnitude.________ Featured Image: Central Toronto. Toronto is the only city outside of the U.S. to be considered by Amazon to host its new headquarters. Photo Credit: Michael Muraz Referenceshttps://www.washingtonpost.com/business/economy/for-finalists-in-the-amazon-headquarters-sweepstakes-the-fun-has-turned-serious/2018/01/26/b517a196-0179-11e8-bb03-722769454f82_story.html?utm_term=.f7e48414fe34Humphreys, Brad R., and Li Zhou. “Sports Facilities, Agglomeration, and Public Subsidies.” Regional Science and Urban Economics, vol. 54, 2015, pp. 60–73., doi:10.1016/j.regsciurbeco.2015.07.004.

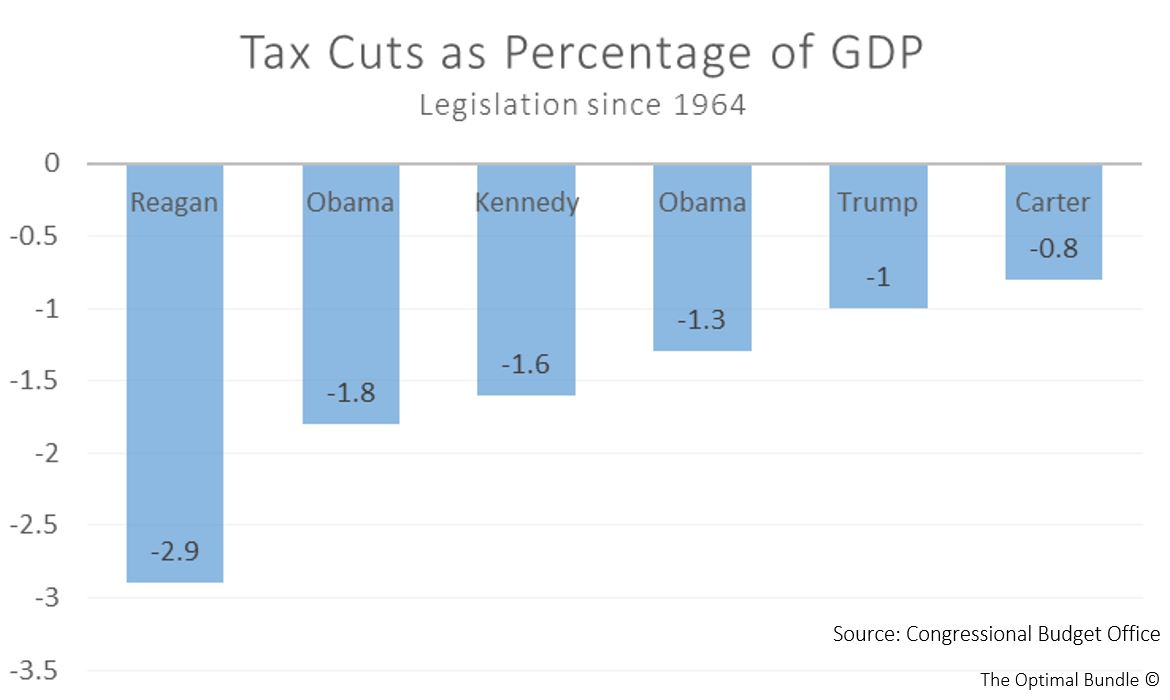

New tax legislation poses challenges for some Americans, but enthuses and incentivizes productivity for others. January 19, 2018

Patrick Reilly, Nazmus Mallick, Avery Ryan, and Peter Scharf

________

The newly passed tax bill, officially legislated as H.R. 1 or Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018, was signed into law by President Donald Trump on December 22, 2017. It passed through the House of Representatives and the Senate along party lines. According to the bipartisan Committee for a Responsible Federal Budget, H.R. 1 includes the eighth largest tax cut since 1918 and the fourth largest since 1949 when adjusted for inflation. It is American firms that are projected to reap most benefits from the new tax bill. For example, Warren Buffett’s Berkshire Hathaway is expected to have a twelve percent increase in profits resulting in a $37 billion gain. In the short-run, both corporations and employees will see benefits resulting from the tax reform, but more time is required in order to see other, more complex effects such as a likely increase in the national deficit. A report released by KPMG immediately following the enactment estimates that the law provides an overall tax reduction of $1.456 trillion over the next decade when not accounting for the fluctuations of the business cycle. One of the provisions within the new law includes the permanent repeal of health care subsidies and the mandate that requires all individuals over the age of twenty-six to join a health insurance system, both which were part of the Affordable Care Act, the Obama Administration’s flagship piece of legislation. Repealing the individual mandate is estimated to reduce the federal deficit by $338 billion within a period of eleven years, but result in 13 million Americans not obtaining health insurance while premiums are projected to increase by ten percent.

According to estimates by Harvard economist Robert Barro, cutting the average marginal tax rate for individuals by 1% will increase GDP by 0.5% over the next two years. In other words, a cut in tax rate will increase the amount of disposable income available to the citizens thus increasing their purchasing power. This will tend to have an expansionary effect on the economy as consumer spending and investment is likely to increase.

Such change in fiscal policy affects several sectors of the American economy. One effect that has been analyzed so far is how the corporate tax cuts within H.R. 1 is affecting activity in capital markets. Currently, the stock market is thriving and many, including the president himself, believe that such growth is catalyzed by the recent tax overhaul.

“Just a few weeks after major tax reform legislation was approved by Congress and signed by President Trump, we are seeing the broad benefits of economic growth...The Dow has climbed to a new all-time record, over 26,000 in the past few days. That reflects $7.2 trillion in new wealth added to the economy over the first year of the Trump presidency, broadly shared by everyone with stock ownership, either directly, or through pension plans and retirement savings.”Lewis K. UhlerFounder, National Tax Limitation Committee

In a January 11 interview with the Wall Street Journal, President Trump told a reporter that, “The tax bill has turned out to be far greater than we ever anticipated… It’s selling itself.” The President's confidence is not left unsupported. Trend Macrolytics LLC Chief Investment Officer Donald Luskin stated that since the passing of the tax bill, Wall Street Journal analysts have increased their projections for earnings in the S&P 500 by an unprecedented 4.6%. Due to the corporate tax cut from 35% to 21%, a confidence boost in the stock market has led to its noticeable growth. Warren Buffet voiced his opinion regarding the tax cut to CNBC, “You had this major change in the silent stockholder in American business who has been content with 35 percent ... and now instead of getting 35 percent interest in the earnings they get a 21 percent and that makes the remaining stock more valuable." While there are pundits and analysts issuing warnings about an impending stock market crash, it is important to remember that markets are dependent on consumer confidence. Bullish activity reveals that at a minimum, investors are confident about the future of the economy under the Trump presidency. In the days following the passage, corporations like Wells Fargo, Bank of America, and J.P. Morgan announced cash bonuses for thousands of their employees, partly due to reinvigorated incentives. The drive for investing means that people are betting on economic success, increased real wages, and higher business profits. All of the effects that the tax cut has had on the stock market seem to be positive due to growth. However, it is important to keep in mind that while this growth enthuses C-suite executives, polls reveal that it does not do the same for a significant portion of the public. The middle class and lower income earners will see mixed results. The Institute on Taxation and Economic Policy analyzed the H.R. 1 to see how tax cuts and hikes were distributed across income percentiles and across time as provisions within the bill change the tax rates by year. These figures also factored in the elimination of the penalty on the healthcare mandate, which is a small tax cut in itself for the lower income earners. The middle 20% of income earners will see a reduction in taxes of about 1.5% in the first years of the bill and that will slowly decrease over time with the 2027 estimate being a net zero change in taxes. The lower middle class, the bottom 20%-40% of income earners, will benefit similarly in 2018 with an expected reduction of 1.3% in taxes that will shrink to a net .5% increase in taxes by 2027. The 60%-80% of income earners will do slightly better with a reduction of 1.6% on their federal taxes to start and a net neutral tax effect by the bills end. By far the winners of this tax bill were the top 10% of income earners who will see reductions of close to 5% on their tax bills and will see slightly smaller decreases through time.The Tax Foundation’s analysis centered on the benefits to hypothetical households involved during the bills early stages in the late 2010s and found that every income level will benefit from the new tax bill. The lower marginal tax rates coupled with a larger standard deduction were the primary reasons for lower taxes among the middle and lower class groups. A larger and more accessible child tax credit is a potential benefit for families in the middle of the income distribution. These calculations were made without factoring in the effect of the individual healthcare mandate and ignore the changing nature of the bill over time.One unlikely entity that will be negatively affected by the new tax bill is Penn State Football. Previously, alumni and other boosters could write off the cost of season tickets and luxury boxes as tax-deductible charitable contributions. According to the newly revised tax code, buying the best seats for a Penn State football game is not considered a charitable donation and is not included in the new law. At the University of Georgia the right to buy luxury box seats can cost $60,000 a year, which was tax deductible. It is now likely that demand for luxury boxes could fall.___________Nicolas Guerrero contributed to this essay. Featured Image:Ben Aronson (1958-present) AmericanSunset, Chicago River (2014) Oil on Panel BibliographyThe First Trump-GOP Tax Bill: National and 50-State Analysis. Institute on Taxation and Economic Policy. December 2017. https://itep.org/wp-content/uploads/Trump-GOP-Final-Bill-Report.pdfLorin, Janet; Novin-Williams Eben. College Football Teams Mount Blitz to Lock In Donors' Tax Breaks. BloombergPursuits. December 22, 2017. https://www.bloomberg.com/news/articles/2017-12-22/college-football-teams-mount-blitz-to-lock-in-donors-tax-breaksShell, Adams. List of companies that paid bonuses or boosted pay since tax bill passed. USA Today. January 11, 2018. https://www.usatoday.com/story/money/2018/01/11/list-companies-paid-bonuses-boosted-pay-since-tax-bill-passed/1023848001/Buhayar, Noah. Berkshire to Reap Estimated $37 Billion Bump From U.S. Tax Cut. Bloomberg LP. January 8, 2018. https://www.bloomberg.com/news/articles/2018-01-08/berkshire-to-reap-estimated-37-billion-bump-from-u-s-tax-cutEl-Sibaie, Amir. Who Gets a Tax Cut Under the Tax Cuts and Jobs Act? Tax Foundation. December 19, 2017. https://taxfoundation.org/final-tax-cuts-and-jobs-act-taxpayer-impacts/Rep. Brady, Kevin. (R-TX) [Sponsor]. United States House of Representatives - 115th Congress (2017-2018). United States House of Representatives Ways and Means Committee. H.R.1 - An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018. Public Law No: 115-97. December 22, 2017. https://www.congress.gov/bill/115th-congress/house-bill/1New Tax Law (HR1) Initial Observations. Klynveld Peat Marwick Goerdeler [KPMG] December 22, 2017. https://home.kpmg.com/content/dam/kpmg/us/pdf/2017/12/tnf-new-tax-law-dec22-2017.pdfTranscript of donald trump interview with the wall street journal. (2018, Jan 14). Wall Street Journal (Online) Retrieved from http://ezaccess.libraries.psu.edu/login?url=https://search-proquest-com.ezaccess.libraries.psu.edu/docview/1987216534?accountid=13158Luskin, D. L. (2018, Jan 12). Tax reform has released the bulls. Wall Street Journal Retrieved from http://ezaccess.libraries.psu.edu/login?url=https://search-proquest-com.ezaccess.libraries.psu.edu/docview/1986575861?accountid=13158Kim, Tae. Warren Buffett says 'huge' corporate tax cut is 'not baked in' stock market. CNBC. January 10, 2018. https://www.cnbc.com/2018/01/10/warren-buffett-says-huge-corporate-tax-cut-is-not-baked-in-stock-market.htmlHarper, Jennifer. Desperate Trump critics rage against the stock market boom. The Washington Times. January 18, 2018. https://www.washingtontimes.com/news/2018/jan/18/though-the-economy-appears-to-be-humming-and-happy/

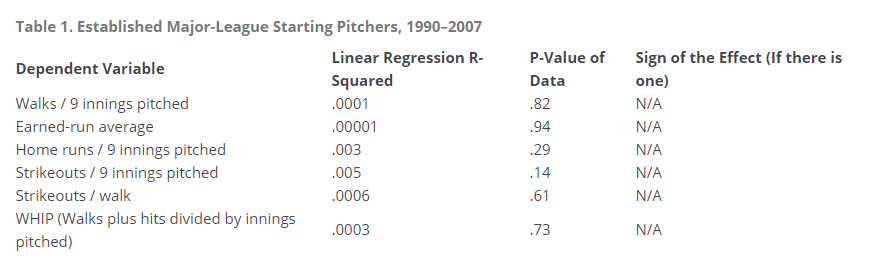

America's favorite pastime undergoes a fusion with the dismal scienceOctober 27, 2017By Peter Scharf

I am a huge baseball fan. I have been watching the MLB-particularly my hometown Philadelphia Phillies-regularly since I was 8 years old. I have attended 50-75 games and watched my boys in red pinstripes play in the National League Division Series, National League Championship Series, and ultimately the World Series. My passion for baseball has not waned since I stopped playing in high school, and, if anything, has increased. My perspective on the game has changed significantly though. Through the coursework of an economics degree, I have gained the skills to not only observe baseball as an outsider, but take my own approach and analyze every player, every game, and every offseason signing. Taking the ideas of economics and combining them with baseball fandom is nothing new, however. Economics has had a grip on baseball since even before my Little League Days.

Economics complements baseball due to the statistics driven nature of the academic field. Baseball is arguably the most stat-driven sport. Baseball executives have begun using similar techniques that a professional economist or business analyst would use and apply them to baseball player acquisition. Game theory has also very recently begun to creep into the world of baseball. While a simplified version of game theory has been in use since the 1800s, today batting coaches and hired analysts are determining to try to compute a pitcher’s move and the batter’s response.

Throughout this piece, I will assume that you have some basic knowledge of the game of baseball. I, however, do not assume you know the full glossary of baseball statistics. Thus, I include the official list of MLB statistics.

A Brief History of Baseball Analytics

Baseball statistics have been around since the 1850’s1 when avid baseball fans could find a player’s batting average, walks, home runs, doubles, triples, and singles through simple arithmetic and analysis of a game’s complete box score. Little changed in the baseball world throughout the next century. While baseball executives certainly used these simple statistics to gauge a potential trade acquisition or draft pick, it was the subjective opinion of a scout who had the most weight.

While scouts insist on drafting taller pitchers. No statistically significant correlation can be found between height (as a function of inches) and pitcher effectiveness.16

Modern baseball statistics, or sabermetrics, began in the 1980s when Bill James, an avid baseball fan and writer, began to publish The Baseball Analyst2. Bill James and other baseball statisticians, known as sabermetricians, were trying to solve issues with traditional measurements. For example, batting average was a great way to find how often a hitter reached base. However, it did not account whether that hit was a single, double, or home run. Thus, slugging percentage (SLG) was created. This new statistic accounted for both, how often a player hits and what base he reached on the hit. Sabermetricians also realized that batting average and slugging percentage did not account for other ways that a player could reach base. On-base-percentage (OBP) was created to factor in walks, hit by pitches, and hits into an average. To determine the general character of a hitter they combined on base percentage and slugging (literally OBP+SLG) to create OPS. OPS is now considered the most accurate statistical representation of a hitter.

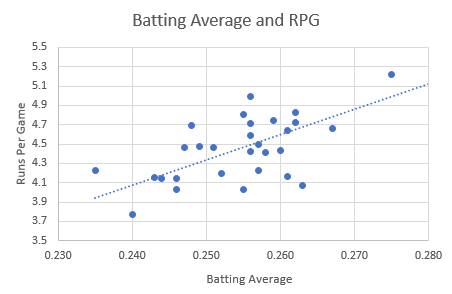

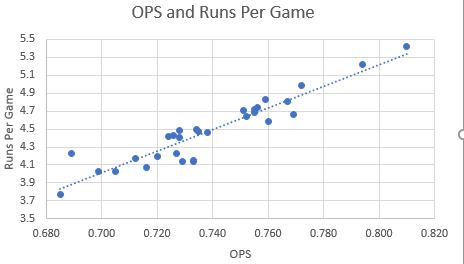

The correlation of Team Batting Average and Runs per Game vs. Team OPS and Runs per Game. Data from the 30 MLB clubs for the 2016 season.

The correlation of Team Batting Average and Runs per Game vs. Team OPS and Runs per Game. Data from the 30 MLB clubs for the 2016 season.

Another advancement on the typical batting average has been the batting average on balls in play or BABIP. Batting average on balls in play considers a player’s chances of getting a hit after they hit the ball into fair territory. Pull hitters and power hitters who play into shifts often have very low BABIP. Contact and slap hitters find holes and get on base more often.

The sabermetric analysis does not end with the offensive side of the game. Sabermetrics have also expanded upon pitching and fielding. For example, rather looking at ERA which may be influenced by the fielding or perhaps lucky hits against a shift. Baseball analytics experts came up with pitcher exclusive statistics like SO/9 which effectively measures a pitcher’s strikeout rate per nine innings or DICE which only considers instances where the fielders never touch the ball like home runs, walks, strikeouts, and hit-by-pitches.

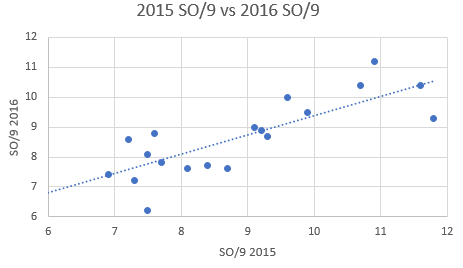

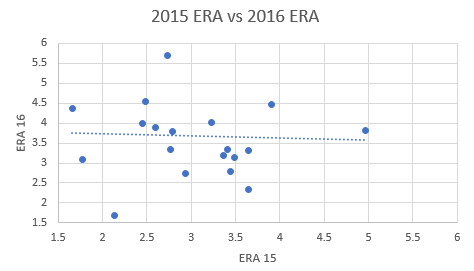

The comparison of ERA and SO/9 among 20 pitchers with more than 300 innings pitched between 2015 and 2016. Note that the ERA of the previous year has no impact on the ERA of the current. The Sabermetric statistic SO/9 has a near 1/1 relationship.

The comparison of ERA and SO/9 among 20 pitchers with more than 300 innings pitched between 2015 and 2016. Note that the ERA of the previous year has no impact on the ERA of the current. The Sabermetric statistic SO/9 has a near 1/1 relationship.

New fielding statistics like range factor have replaced the traditional fielding percentage. Fielding Percentage merely takes the percentage of the times a player fields a ball cleanly and fields it without error. Range factor takes into effect a player’s ability to cover the field. For a hypothetical example, say you have a slow outfielder who rarely gets to make a play on a ball because he is so slow. His fielding percentage may be very high (you cannot make an error if you never make it to the ball) but his range factor would give a better description of the fielder he is. To properly evaluate range factor one must take into account the position a player is fielding from. For example, a shortstop sees much more action than a first baseman.

From the ground of all these newer baseball statistics grew WAR or wins above replacement. Among sabermetricians today, WAR is the final and most accurate measure of how “good” a baseball player is. WAR is an attempt to determine how valuable a certain player is to the team. Essentially, it compares a given player to a hypothetical “replacement” who is league average in every statistic. WAR has no standard way to be calculated, rather each individual baseball statistics website calculates its own version. Rather than spend the next 10 pages discussing the ways WAR can be calculated if you are interested check out Baseball Reference and Fangraphs descriptions of WAR.

Through technological advances of the recent years, physics-based sabermetrics have begun to dominate the sport. The two most talked about are exit velocity and launch angle. Exit velocity is the speed, generally in mph, that a ball leaves the bat. Launch angle is the angle by which the ball is hit from the plate. Low launch angles result in ground balls and infield outs. High launch angles result in pop-ups. Good hits are described at having launch angles 25-35 degrees.

Sabermetrics and How the Economists Took Over the Front OfficeSabermetrics first reached the front office of an organization with Billy Beane and the Oakland Athletics. This account is made famous because of the book and movie Moneyball3. To summarize the Oakland Athletics have some of the lowest payroll in the league. To remain competitive, GM Billy Beane, stuck to a strict sabermetric approach to try to find undervalued players that they would not have to pay as much for. Since the release of the book and movie, as well as the spread of Beane’s management tree around the league, sabermetric analysis has been taken over Major League Baseball. As a result, management offices are rushing to find the next edge.

Sabermetrics and How the Economists Took Over the Front OfficeSabermetrics first reached the front office of an organization with Billy Beane and the Oakland Athletics. This account is made famous because of the book and movie Moneyball3. To summarize the Oakland Athletics have some of the lowest payroll in the league. To remain competitive, GM Billy Beane, stuck to a strict sabermetric approach to try to find undervalued players that they would not have to pay as much for. Since the release of the book and movie, as well as the spread of Beane’s management tree around the league, sabermetric analysis has been taken over Major League Baseball. As a result, management offices are rushing to find the next edge.

Former A’s GM and sabermetric pioneer Billy Beane

Former A’s GM and sabermetric pioneer Billy Beane

Billy Beane’s popularity was not just driven by a movie and book, however. During his reign from 1999-2012 (he actually started in 1995 but his drafting and acquisition decisions did not begin culminating until the late 90s) the Oakland A’s posted a .527 winning percentage from a record of 1621-1453. During this time he had over 90 wins, a great achievement in baseball, on 8 different occasions and made the postseason on 6 different occasions.8 Billy Beane and crew were also able to sabermetrically mine hidden prospects like Nick Swisher, Joe Blanton, Barry Zito, Mark Mulder, Bobby Crosby, and submarine reliever Chad Bradford.

Because of the driven towards statistics driven baseball, teams needed management that were skillful with numbers and applying them to human interaction. Consequently, economists began to fill the ranks. Of the general managers in baseball today, Matt Klentak of the Philadelphia Phillies, Dick Williams of the Cincinnati Reds, Mike Chernoff of the Cleveland Indians, Jeff Luhnow of the Houston Astros, Derek Falvey of the Minnesota Twins, Mike Girsh of the St. Louis Cardinals, Matthew Silverman of the Tampa Bay Rays, and Ross Atkins of the Toronto Blue Jays all have undergraduate degrees in economics or finance.4 The L.A. Dodgers quit beating around the bush and hired a full-on Ph.D. in Economics from the University of California, Berkeley in Farhan Zaidi. In the baseball executive world, math skills have overtaken baseball skills with only 1 current GM having played.5

Dodger’s GM and Ph.D. economist Farhan Zaidi

Dodger’s GM and Ph.D. economist Farhan Zaidi

Economists are not only ruling the front office. The more advanced sabermetric and baseball forecasting systems have been developed by economists. A quick scan of Fangraphs’ writers shows economists popping up everywhere.6

In the baseball executive world, math skills have overtaken baseball skills with only one current GM having played.

The by far most well-known sabermetrician not holding a team executive position is stat king Nate Silver. Before his days running the super popular FiveThirtyEight, Nate Silver first gained his statistics experience running Player Empirical Comparison and Optimization Test Algorithm or PECOTA. The goal of PECOTA was to predict the expected performance of any given baseball player or prospect either in the next season or throughout a whole career. Since its early founding, PECOTA has outperformed many established baseball forecasting systems.7

Kyle Hendricks: The Pitching Economist

To a scout or a self-described baseball expert, Cubs pitcher Kyle Hendricks has few qualities that would make you think he can pitch at the Major League level. To start, he was not a highly regarded prospect coming out of high school. He was denied scholarship offers from elite “baseball schools” and instead went to Dartmouth for academic reasons. His pitch velocity is extremely slow, most of his pitches do not top the mid-80s and he is getting slower every year.9 So how does this scrawny pitcher become subject to Cy Young talk every year? Well, to start, he has pin-point accuracy on his pitches, a variety of pitches, and an economics degree (with a minor in mathematics).

Kyle Hendricks, nicknamed “The Professor,” studies opposing hitters. Leading up to every game he goes through the entire batting lineup of a team, finding each batter's weaknesses and strengths and using it against them. With each at-bat, he goes in with a strategy. While Hendrick’s keeps most of his secrets to himself and his coaches, the sabermetricians are beginning to figure him out. Starting every at-bat, Hendricks “steals” a strike. The Professor has a belief that most hitters in the league will take on the first pitch to adjust to a pitcher, especially to a multi-pitch freak like himself. Hendricks is second in the league in first-pitch strikes, and averages almost 3 called first-pitch strikes for every swinging one.10 It as if hitters have just given up on the first pitch.

Additionally, Hendrick’s uses coach and hitter expectations to form his pitching style. He does this in two main ways. First, he has additional pitches that remain hidden, in addition to his already extensive known repertoire. For years he got away with a second changeup that was only relieved when sabermetricians noticed discrepancies between his changeup velocity and breaks.11 It was also found that he had a second curveball which has shown increased use over the years.12 Second, he goes against “conventional baseball wisdom” in pitch selection. While most baseball pitchers rely on the fastball as a primary pitch and breaking balls as a secondary pitch, Hendricks uses all his pitches with relative frequency. He lacks the primary-secondary pitch sequence. In complete ire of traditional baseball pitching style, Hendricks throws his changeup at a greater frequency (24.27%) than his four-seam (15.85%).13

Breaking New Ground with Game Theory

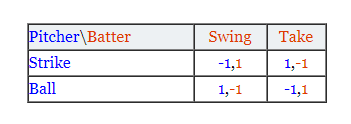

Although statistics have been an important part of baseball for the past 20 years, newer forms of mathematical thinking like game theory have yet to catch on. While few baseball players have any academic experience with game theory, a simplified version is well understood by every baseball player. Basically, an AB is much like a game of matching pennies. The pitcher benefits from a disagreement, while the batter benefits from an agreement. A good pitcher will thus try their best to create uncertainty for a batter.

Simplified version of a zero-sum matching pennies game applied to baseball. [15]

Simplified version of a zero-sum matching pennies game applied to baseball. [15]

This is, of course, an oversimplified version of the baseball. Adding variables like batter/pitcher matchup, men on base, score, inning, lineup, etc all would make the game more and more complicated, and requires an analysis that would exceed the capacity I am willing to do for this blog post. An illustration of this complexity can be found from a UC Berkeley paper on the 8th inning of a game between the Giants and Dodgers14. Game theory has also begun to creep into the amateur baseball blogs15.6 Perhaps in the future game theory will take over the baseball world.

So far, the limit of game theory in baseball has been in an academic context. A great analysis of a game can be found here. This paper analyzes the 8th inning the April 18th, 2010 game between the LA Dodgers and the San Francisco Giants. Although this paper features just two batters in one-half inning it illustrates how game trees in baseball quickly become complex. Perhaps the greatest challenge to game theory and baseball has been the complexity involved. So many factors have to be taken into consideration for something as simple as where to pitch.

To conclude, baseball has become a bit of a hobby for economics, mathematics, and statistics majors like myself. Through the sport’s unique design, a fan can participate, not as a player, but an analyst. Through the democratization of information via the internet, being a baseball fan is a totally different experience than 50 years ago.

______Featured image: Citizens Bank Park looking north toward central Philadelphia. Photo credit: Penn State Bibliography Puerzer, R. J., (2002) From Scientific Baseball to Sabermetrics: Professional Baseball as a Reflection of Engineering and Management in Society. NINE: A Journal of Baseball History and Culture (11)James, B., Birnbaum, P., Roney, S., Pavitt, C., Palmer, P., Blau, C., . . . Mednick, B. (n.d.). Baseball Analyst archives. Retrieved from http://sabr.org/research/baseball-analyst-archivesLewis, M. (2003). MoneyBall. New York, NY: W. W. Norton & Company.List of current Major League Baseball general managers. (2017, October 2). Retrieved from https://www.baseball reference.com/bullpen/List_of_current_Major_League_Baseball_managersJohns, G. (2015, September 28). Jerry Dipoto named Mariners general manager.Fangraphs Writers. (2017, September 15). Retrieved from https://en.wikipedia.org/wiki/Fangraphs#Regular_writersSilver, N. (2004, January 15). PECOTA Takes on the Field: How'd it Fare Against Six Other Projections Systems?Oakland Athletics Team History & Encyclopedia. (n.d.). Retrieved from https://www.baseball-reference.com/teams/OAK/index.shtmlKyle Hendricks. (2017, October 25). Retrieved from http://www.fangraphs.com/pitchfxo.aspx?playerid=12049&position=P&pitch=SI&data=piEckert-Fong, T. (2016, August 17). Why do hitters rarely swing at first pitches from Kyle Hendricks? Retrieved from https://www.beyondtheboxscore.com/2016/8/17/12505864/kyle-hendricks-cubs-first-pitch-strike-swingSarris, E. (2015, October 20). Kyle Hendricks Has Two Changeups. Retrieved from https://www.fangraphs.com/blogs/kyle-hendricks-has-two-changeups/Weinberg, N. (2016, October 28). The Evolving Curveball of Kyle Hendricks. Retrieved from https://www.fangraphs.com/blogs/the-evolving-curveball-of-kyle-hendricks/Kyle Hendricks: Trajectory and Movement. (n.d.). Retrieved from http://www.brooksbaseball.net/tabs.php?player=543294&time=&startDate=03%2F30%2F2007&endDate=09%2F30%2F2017&s_type=2Geblem, Laucys, Saperstein, & Sodha. (2010, May 13). The Game Theory of BaseballSwartz, Matt. “Game theory and baseball, part 1: concepts.” The Hardball Times, Fangraphs, 17 Dec. 2012, www.fangraphs.com/tht/game-theory-and-baseball-part-1-concepts/.Greenberg, G. (2010, Fall). Does a Pitcher's Height Matter? Retrieved from http://sabr.org/research/does-pitcher-s-height-matter Further Readinghttp://www.mathaware.org/mam/2010/essays/AlbertSabermetrics.pdfhttp://sabr.org/sabermetrics

Britain's decision to leave the European Union continues to prompt more questions than answers for global markets.October 23, 2017By Nazmus Mallick

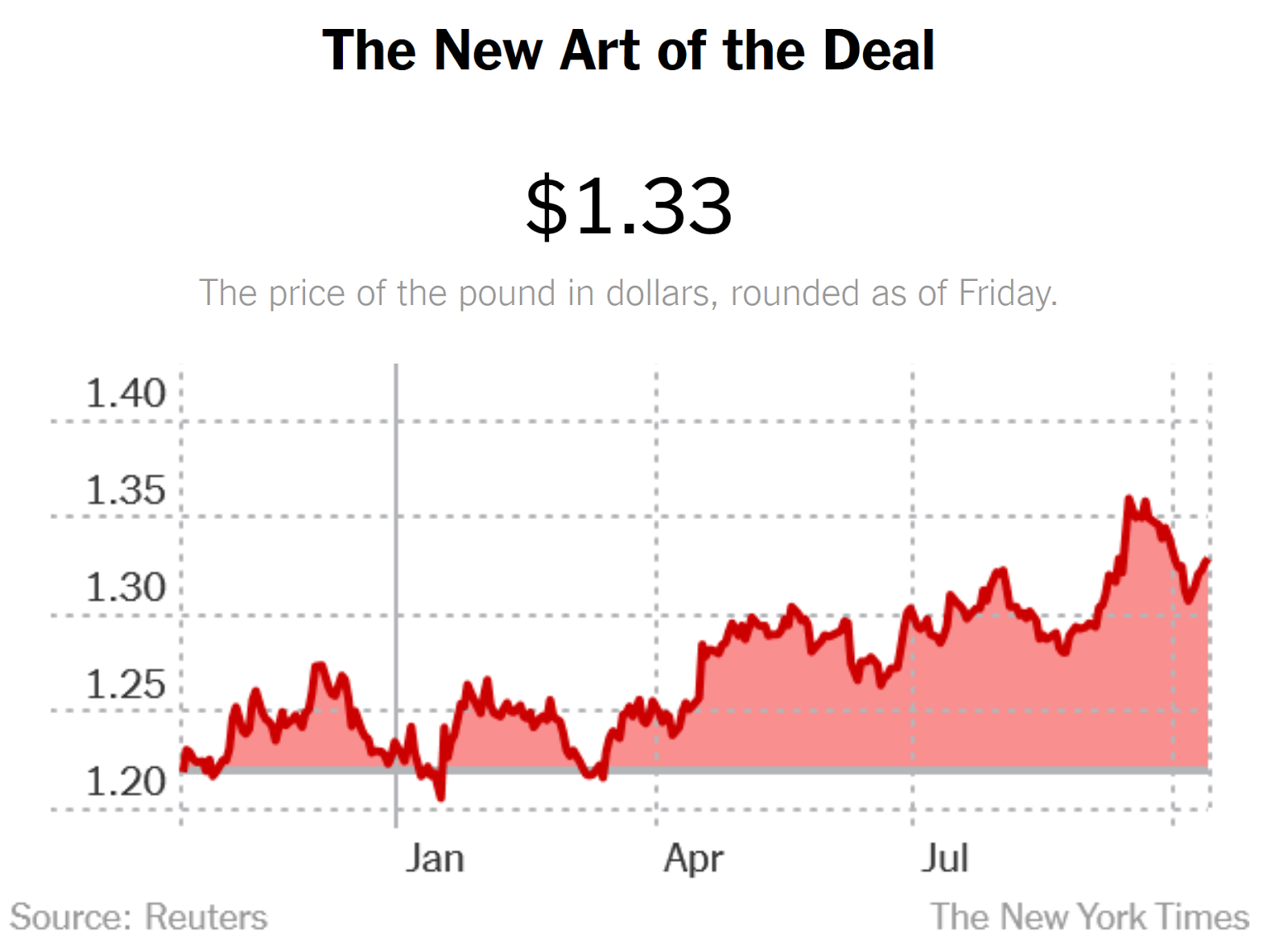

June 23, 2016 is a day redefined Britain’s relationship with the world. It has been sixteen months since the British people voted in a referendum to withdraw their country from the European Union (EU). As predicted by countless experts in academia and industry, the British economy is currently undergoing a period of uncertainty. Some of its closest trading partners, mainly United States, are carefully observing fluctuations in the British economy to see how any bilateral negotiation with a more isolated Britain will impact Anglo-American trade.On June 24 at 12:28 AM Manhattan time, the value of pound experienced a plunge against the US Dollar to its lowest level in 31 years (Figure 1).

Figure 1

According to The New York Times, the pound has dropped 10% since it was valued at $1.47 just before the decision to leave the EU. The most obvious cost of the plummeting value of the pound is the rising cost of imports. British people will no longer be able to enjoy foreign luxury goods due to rising prices and so will be deterred to make further purchases of imported goods overall. An example of this effect is seen between Unilever and a supermarket chain as the former threatened to withdraw products such as Marmite, a yeast-based spread, from the shelves. Items from Apple and Microsoft also saw increase in prices throughout the British market. A significant amount of British jobs are at stake. Once Britain is denied access to the common market, economists predict that British firms will be forced to lay off workers. Around 25% of financial companies are expected to move their operations overseas due to the cloud of uncertainty. Major investment banks like Goldman Sachs, JPMorgan, and Morgan Stanley are expected to move key operation divisions to Frankfurt, Paris or Dublin in order to hedge from any upcoming risk. This decision brought some negative signs for Americans. According to Washington Post’s Ylan Mui, more than a million people in Britain is employed in American businesses. The uncertainty that surrounds this decision is enough to jeopardize the job security of these workers.

Around 25% of financial companies are expected to move their operations overseas due to the cloud of uncertainty.

Furthermore, this article also suggested that US is the single largest investor in Britain. Many firms in US consider UK to be the main way to conduct businesses with all the 28 nations of the EU. For this reason, a departure from the EU will hurt US businesses very sharply by restricting access to these markets, reducing the revenue streams of US businesses, and forcing firms to shift their operations in the European markets in other places. The negative effects of these factors can be manifold. There will be a serious decline in exports of US products as they will become very expensive.

Caterpillar opened its first factory in Britain more than 55 years ago. It currently employs 9000 employees and operates 16 plants across Britain. Around a quarter of Caterpillar’s sales revenue come from European businesses. This poses unprecedented risk for the business community in Europe, as it will likely trigger a decline in Europe-centered sales for Caterpillar.

The Federal Reserve has been under the dilemma of raising short term benchmark interest rates. Brexit has intensified the Fed’s prospects for action. Since the Great Recession, the Fed has maintained interest rates at rock-bottom levels in an effort to spur consumption and boost aggregate demand. Brexit is cold make the waiting period for raising rates lengthier. According to Rana Foroohar of Time Magazine, the balance between costs and benefits has been deteriorating and this is very clearly seen from growing corporate debt, hesitancy of consumers to increase their consumption as they are uncertain about the strength of the recovery, etc. Since 2008, legislators were very reluctant to pass fiscal measures for an accelerated recovery. As a result, this placed increased responsibility on the central bank to steer the economy, maintaining strong growth and maintain price stability. However, rising corporate debt and shrinking economic growth associated with the crisis has put increased pressure on the banks to cope with the situation. They don’t have sufficient liquidity due to default risks and so national governments will have to take on this additional responsibility.

While uncertainty has creeped into the British economy, causing its growth to lag behind all developed countries, there are signs for calm. London is likely to remain an unrivaled center of finance due to its long-rooted institutions. International firms such as Facebook and Bloomberg LP are setting up their headquarters along the Thames at the same pace as banks reallocate divisions to other European capitals. The disruption of human capital can pose further challenges, forcing the Conservative May Government to announce actions regarding labor regulation that the Peterson Institute has criticized as being out of the “Pre-Thatcherite Labour rhetoric”. If legislators on both sides of the Atlantic can take preventive measures from any unwanted shocks, it can serve as a valuable safeguard for the economies of both, the United States and Britain.

____

Featured image: Central London. The River Thames flows south of Buckingham Palace, St. James Park, Westminster and Whitehall. Upon bending eastward at Charing Cross, it swerves through the financial districts of City of London and Canary Wharf in the distance. Credit: Jason Hawkes

ReferencesIndependent. Chu, Cox and Rodionova, (22 June, 2017). Brexit: The economic and business cost to Britain one year after the vote. Retrieved October 14th 2017, from http://www.independent.co.uk/news/business/news/brexit-latest-news-business-economic-costs-banks-one-year-vote-anniversary-eu-exit-a7802596.htmlThe Washington Post. Mui Y, (June 18, 2016). ‘Brexit’ could send shock waves across U.S. and global economy. Retrieved October 14th 2017, from https://www.washingtonpost.com/news/wonk/wp/2016/06/18/how-brexit-could-hurt-america/?utm_term=.bc6ee92a9930NurseBuddy. Retrieved October 14th 2017 from https://nursebuddy.co/blog/brexit-mean-uk-care-companies/Time. Foroohar (June 27, 2016). Why Brexit Really Is a Big Deal for the U.S. Economy. Retrieved October 14th 2017 from http://time.com/4383202/brexit-america-fallout-economy-fed/

Cryptocurrencies are a rising phenomenon...maybe? October 2, 2017By Patrick Reilly

Cryptocurrencies such as Bitcoin, Litecoin, Ethereum and others have been gaining popularity. While still not generally understood by the average person, these “currencies” have risen exponentially in value over recent years. This has attracted the attention of such notorious investors as self-described Floyd “Crypto” Mayweather, Barcelona soccer player Luis Suarez and famous person Paris Hilton.

So what exactly is cryptocurrency and what is it you used for? According to Investopedia, cryptocurrency is “a digital or virtual currency that uses cryptography for security...is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.” So cryptocurrencies such as bitcoin are completely digital and aren’t owned by anyone. There is no sort of “internet federal reserve” out there controlling bitcoin as a currency, this lack of control amazingly works and provides one of the benefits of bitcoin: nearly non existent transaction fees. Whenever you buy something with your credit card from Visa or Mastercard there’s nearly a 3% fee that is deducted. There is also no way to tax purchases done through bitcoin because there’s no one overseeing the currency and tracking every purchase. Many of the other advantages of bitcoin mostly apply to those who work outside of the law. There is no enforcement mechanisms that can freeze a bitcoin account like they could freeze a standard bank account. Also since there is no one tracking bitcoins--they can be used safely for illegal activities on the internet, such as drug trafficking and money laundering.

Now why are cryptocurrencies gaining popularity and why on Earth is Paris Hilton involved? This is most likely because of the exponential rise in the price of a single bitcoin and the success of other online currencies. Everyone who thinks that Bitcoin is the way of the future is looking back at the price of one bitcoin around 2010 and they don’t want to make the same mistake again. One Norwegian man was lucky enough that he wrote a thesis on encryption and just decided to buy about $25 of bitcoin in 2009. He forgot about it for 4 years until he saw bitcoin on the news, that $25 today would be worth about $18,500,000. While that’s great for that guy, in my opinion, speculation is the main reason that bitcoin has had such an incredible rise. People buy bitcoin, wait for the price to rise and then sell it to the next fool who wants to do the same thing. I see bitcoin as a game of musical chairs between speculators and once the music stops there will be a steep decline in the already volatile currency.

Jamie Dimon, CEO of JPMorgan, recently said that “cryptocurrencies are creating something out of nothing that to me is worth nothing”.

While I will not be an investor in bitcoin I do see the potential that others see. The potential for internet payments that aren’t government tracked, taxed or come with ridiculous fees. On the other hand paying thousands of United States dollars for one unit of an internet currency with no tangible value or hard assets behind it seems like the definition of a bubble.

______ References Kessler, Andy. (2017, August 27) The Bitcoin Valuation Bubble. Retrieved fromhttps://www.wsj.com/articles/the-bitcoin-valuation-bubble-1503868225Investopedia. Cryptocurrency. Retrieved fromhttp://www.investopedia.com/terms/c/cryptocurrency.aspInvestopedia. What are the advantages of paying with Bitcoin? Retrieved fromhttp://www.investopedia.com/ask/answers/100314/what-are-advantages-paying-bitcoin.aspGraham, Luke. (2017, September 22) Governments will close down bitcoin and cryptocurrencies if they get too big, warns Jamie Dimon. Retrieved fromhttps://www.cnbc.com/2017/09/22/bitcoin-jpmorgans-jamie-dimon-lays-into-bitcoin-again.html Author: Patrick ReillyNote: This Volume was previously published on September 26, 2017. The online upload date does not reflect the original publication date.

September 19, 2017By Nicolas Guerrero

Glass-clad skyscrapers rise above a palm-lined waterfront. The financial district, bustling with foreign expats, lies surrounded by the pristine waters of the Persian Gulf. Opposite the harbor is the Museum of Islamic Art, an iconic limestone structure designed by American architect I.M. Pei. The nearby historic quarter is undergoing a multi-billion dollar revitalization as a world-class cultural destination, and the leading fashion houses of Paris and Milan are betting on premium square footage along downtown’s future climate controlled boulevards. A constant flow of jet streams come from the east, where an alluring new airport seeks to become the new hub of intercontinental connections.

Doha—the royal capital of Qatar—spares no detail in showcasing its economic prowess.