A lucrative but geographically challenging market is the battleground for some of the Commonwealth's largest health networks. March 7, 2018By Nicolas Guerrero_____

In the years following the implementation of the Affordable Care Act, its provisions and resulting cost increases led to a series of reconfigurations in healthcare markets across the country. Pennsylvania is a market where healthcare providers and insurers have found a particular need for steadfast consolidation.

Three entities dominate a geographically challenging, yet lucrative healthcare market. The University of Pittsburgh Medical Center (UPMC) is the largest non-governmental employer in Pennsylvania. Headquartered in downtown Pittsburgh, UPMC operates over thirty hospitals in the western and central regions of the state. In addition, UPMC Insurance Services covers over 3.4 million members.

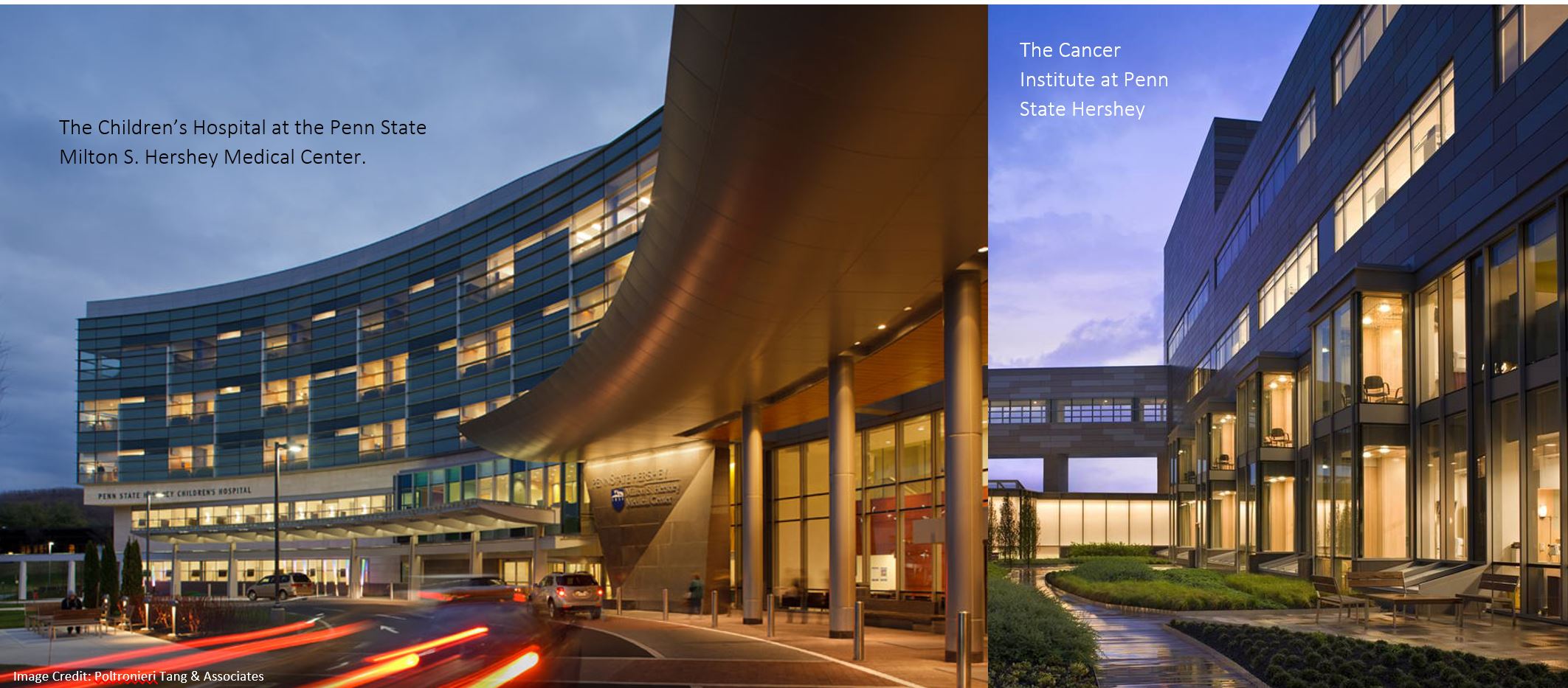

Penn State Health operates the flagship Milton S. Hershey Medical Center, Children’s Hospital and Cancer institute in Hershey, the Penn State Health St. Joseph Hospital in Reading, and 120 medical offices across the Commonwealth. Generating between $1.3 and $1.5 billion in annual revenue, Penn State Health is a major health system and its flagship hospital is the largest in the Greater Harrisburg region.

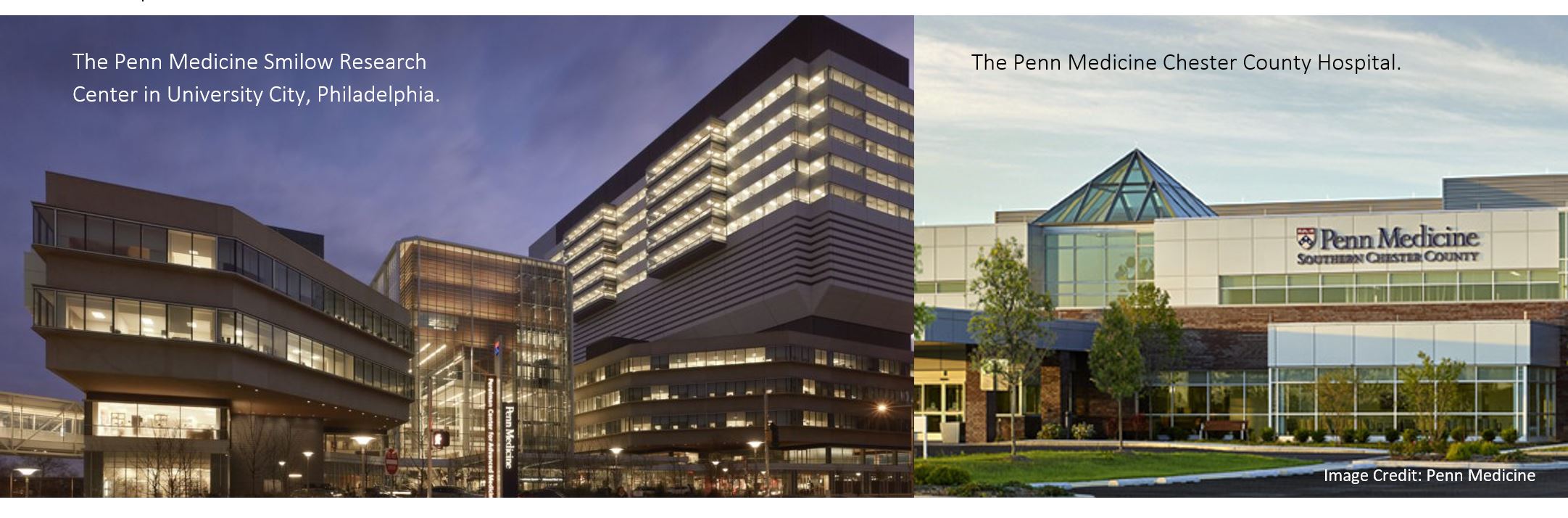

The University of Pennsylvania Health System, Penn Medicine is the state’s second most lucrative network after UPMC generating around $5.3 billion in annual revenue and operates six hospitals and eight multispecialty facilities along the eastern flank of the state.

The urban markets of Philadelphia and Pittsburgh are separated by 300 miles of vast, sparsely populated rural countryside where medical facilities are likely operated by a dominant regional health system.

In March 2015, the Penn State Milton S. Hershey Medical Center completed plans to merge with PinnacleHealth System, the other dominant healthcare provider in the Harrisburg area. Together, both entities would operate as a single network providing health services for Dauphin County and surrounding markets. In December of that year, The Federal Trade Commission (FTC) filed a lawsuit halting any further action and requesting further information. The FTC, along with the Pennsylvania Office of the Attorney General argued that such merger would create a regional monopoly, increasing prices and potentially lowering quality for the South-Central Pennsylvania market. Yet markets are ambiguous and difficult to make out with naked perceptions.

This particular point was made by the United States District Court, which argued that the FTC had failed to define which specific markets would be harmed by the merger. For horizontal mergers, such as the one between Penn State Hershey and PinnacleHealth—where both merging entities are within the same or similar industry—federal anti-trust authorities apply the hypothetical monopolist test to clearly define such market. In this test, the relevant geographic market is the smallest area in which a single firm could raise prices without consumers resorting to firms outside the region to avoid such a price increase.

The Harvard Law Review notes that District Court found that the FTC had not adequately defined the relevant market as the four-county area around Harrisburg, and “that 43.5% of Penn State Hershey’s patients travel to the hospital from outside of the region, suggesting that the FTC’s proposed market failed to properly account for where the hospitals draw their business”. When the Third Circuit Court of Appeals reversed the District Court’s decision, Penn State spent $17 million on legal arguments in an unsuccessful attempt to push for the merger. The motivation behind the Penn State Hershey-PinnacleHealth merger focused on the benefits by scale economies in a market perceived as underserved by University officials and Pinnacle executives. The 64% market share that both entities would have represented in the region was to be transitory, as equally large health “megasystems” such UPMC and Penn Medicine were quickly expanding into the central Pennsylvania market.

Penn State Hershey CEO Craig Hillemeier argues that with Penn State Hershey operating at near full capacity, the merger would have given the medical campus the size and efficiencies required to compete with entering firms without sacrificing patient care. According to both entities, merging the firms would have led to decreased operating costs, increased flexibility in transferring patients to other hospital locations, lower construction costs, and lower costs for patients on a case-by-case basis. The Penn State University Board Trustees dropped all litigation efforts the following year. The projected legal costs coming out of University coffers outweighed the benefits of completing what seemed to be a lengthy merger process.

PinnacleHealth already searching for capital, immediately shifted its focus to its next potential partner. In 2017 PinnacleHealth successfully merged with UPMC, further consolidating Pennsylvania’s largest health system. As predicted, the newly created UPMCPinnalce expanded quickly, operating 12 hospitals in ten counties across central Pennsylvania.

PinnacleHealth already searching for capital, immediately shifted its focus to its next potential partner. In 2017 PinnacleHealth successfully merged with UPMC, further consolidating Pennsylvania’s largest health system. As predicted, the newly created UPMCPinnalce expanded quickly, operating 12 hospitals in ten counties across central Pennsylvania.

Expanding in this region is cost-effective for a behemoth like UPMC, where operating costs for existing hospitals and construction costs for new ones are relatively low. Some of these regional hospitals have between ten and sixty beds and serve markets that no other healthcare provider would likely find economic sense in entering.

Lancaster General Health was acquired by Penn Medicine in 2015. This westward encroachment by a Philadelphia-based firm alerted UPMC and Penn State Health, as the fragile central Pennsylvania market has relatively fixed demand. This contributed to Penn State’s increased “megasystems” competition argument during federal litigation. Should Penn Medicine seek to expand beyond Greater Philadelphia, it will add more pressure to competing health systems, and find several health networks already setting their eyes on the lucrative region. That is what UPMC discovered and successfully tackled when it expanded eastward of Pittsburgh. Penn Medicine has the financial resources and acclaimed reputation to be just as successful.

With health systems quickly growing across the Commonwealth, Penn State Health sought to find a partner that would be reputable and profitable in the face of aggressive competition. After the failed attempt to merge with PinnacleHealth, university resources had to be used carefully, objectives had to be clear, and litigation avoided if possible. Without being neither a merger nor acquisition, Penn State Health partnered with Highmark, the largest insurance provider in the state.

Under this agreement, Highmark ends its partnership with UPMC, and gives an infusion of capital to Penn State Health, allowing it to build new hospitals and facilities to directly compete for UPMC’s consumers. $1 billion will be used to update and expand Penn State Health operations. In exchange, Highmark will send its members to the Penn State Health system hospitals and physicians. The insurer now has three seats on Penn State Health’s fifteen-person board. Thus, Highmark becomes a healthcare insurer and provider through this partnership, just like UPMC.

___________ Featured Image: The Susquehanna River flows through central Pennsylvania Image Credit: Pubic Domain

So, what happened here? Three-point shots are worth more than one expected point, and not until you get within the foul line are shots worth more than 1 expected point. Being that defenses make it more difficult to get to the basket, often times it is a best response to not dribble in towards the hoop, but rather step back and take a three.Across a season with 1000s of shots being taken, the law of averages sways in your favor. The dominant strategy ends up being a mixed strategy of taking shots underneath, in the in the red and blue zones, as well as beyond the three-point arc in the purple. The green and yellow are not best response shots because if you can not get the ball to the red or blue, you are better off passing it behind you and taking a three.So what does a game plan look like following this strategy? Basically, shooters are posted on the outside around the three-point line and a big man is posted up underneath the basket. The point guard brings the ball up and attempts to get the ball to the big man as shots under 10ft are worth 1.32+ and if that is unavailable, he passes to one of the shooters for an expected shot value of 1.08. Following this plan of maximizing expected shot value, the team should average over 100 points per possession. Here is what it looks like in action.This is a screenshot of the Sixer’s March 19 win over the Hornets.

So, what happened here? Three-point shots are worth more than one expected point, and not until you get within the foul line are shots worth more than 1 expected point. Being that defenses make it more difficult to get to the basket, often times it is a best response to not dribble in towards the hoop, but rather step back and take a three.Across a season with 1000s of shots being taken, the law of averages sways in your favor. The dominant strategy ends up being a mixed strategy of taking shots underneath, in the in the red and blue zones, as well as beyond the three-point arc in the purple. The green and yellow are not best response shots because if you can not get the ball to the red or blue, you are better off passing it behind you and taking a three.So what does a game plan look like following this strategy? Basically, shooters are posted on the outside around the three-point line and a big man is posted up underneath the basket. The point guard brings the ball up and attempts to get the ball to the big man as shots under 10ft are worth 1.32+ and if that is unavailable, he passes to one of the shooters for an expected shot value of 1.08. Following this plan of maximizing expected shot value, the team should average over 100 points per possession. Here is what it looks like in action.This is a screenshot of the Sixer’s March 19 win over the Hornets. The Sixers, in blue, have all their offensive scorers located in areas that maximize expected shot value. Dario Saric, the player just beyond the arc taking the shot, Robert Covington, Saric’s left, and JJ Reddick, far corner, are all ready shooters with a high expected shot value because they are beyond the three. In this specific case, Saric, Reddick, and Covington are elite shooters and all shoot above 40% from three making their expected shot value 0.40*3=1.2. The other Sixer, Amir Johnson, is directly underneath the basket anticipating a pass or a rebound for another shot with a high expected value. The only Sixer not in a maximized space is Ben Simmons who brought the ball up to the foul line then turned around a passed it to Saric because the expected value of a foul line shot from Simmons is less than a Saric three.Philadelphia 76er’s former GM Sam Hinkie realized this as well. When selecting players in the draft or through transactions with other teams, he picked either big men or shooters. The plan was to run a maximized offense for the next 10 years. While Sam Hinkie is no longer GM of the Philadelphia 76ers, his selected shooters in Robert Covington and Dario Saric as well as big men in Joel Embiid and Richaun Holmes continue to run this analytic based offense.

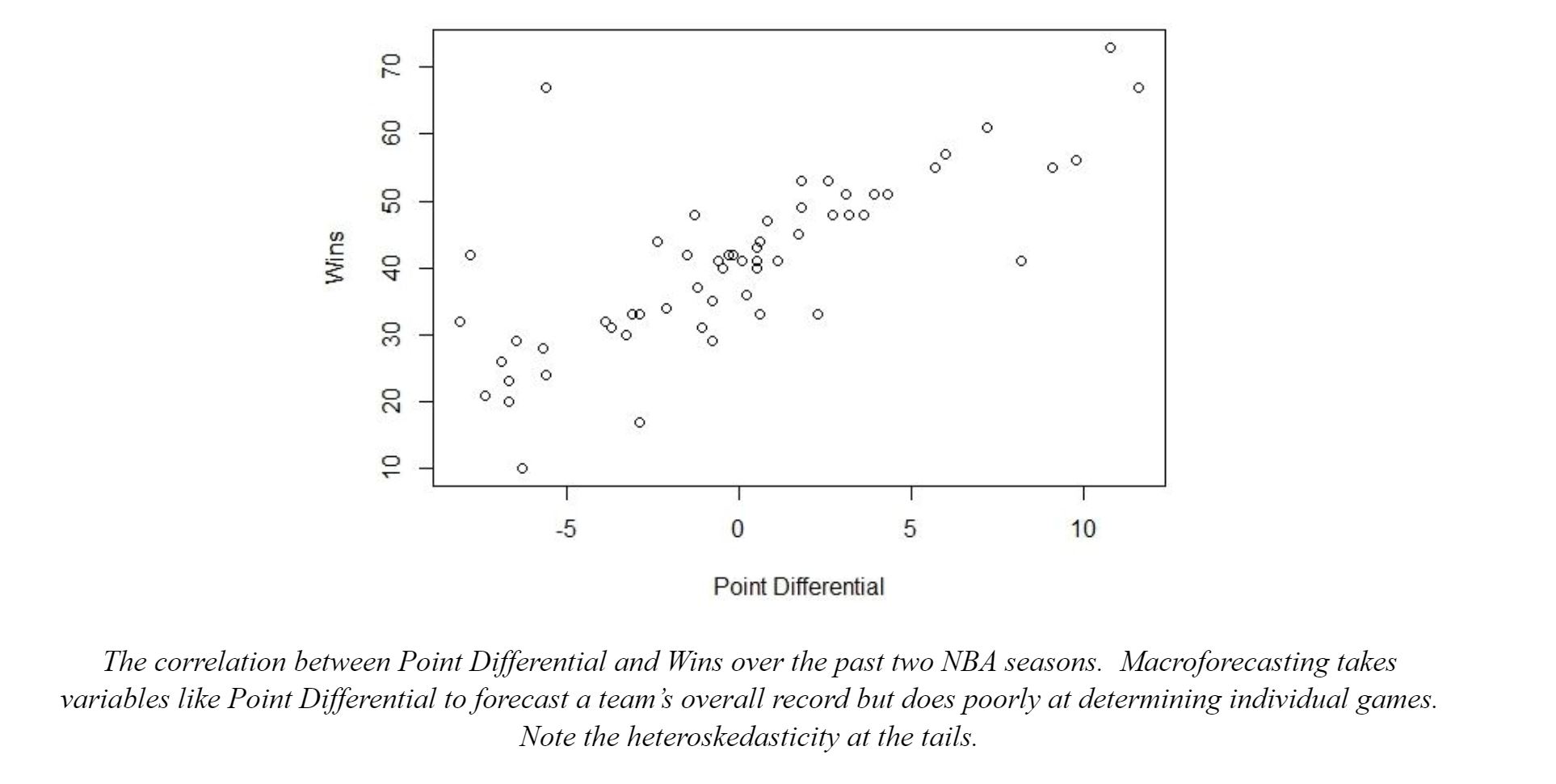

The Sixers, in blue, have all their offensive scorers located in areas that maximize expected shot value. Dario Saric, the player just beyond the arc taking the shot, Robert Covington, Saric’s left, and JJ Reddick, far corner, are all ready shooters with a high expected shot value because they are beyond the three. In this specific case, Saric, Reddick, and Covington are elite shooters and all shoot above 40% from three making their expected shot value 0.40*3=1.2. The other Sixer, Amir Johnson, is directly underneath the basket anticipating a pass or a rebound for another shot with a high expected value. The only Sixer not in a maximized space is Ben Simmons who brought the ball up to the foul line then turned around a passed it to Saric because the expected value of a foul line shot from Simmons is less than a Saric three.Philadelphia 76er’s former GM Sam Hinkie realized this as well. When selecting players in the draft or through transactions with other teams, he picked either big men or shooters. The plan was to run a maximized offense for the next 10 years. While Sam Hinkie is no longer GM of the Philadelphia 76ers, his selected shooters in Robert Covington and Dario Saric as well as big men in Joel Embiid and Richaun Holmes continue to run this analytic based offense. Former Sixers GM Sam Hinkie talks with a young Joel Embiid shortly after his drafting. Using Econometrics to Forecast Basketball Games (and doing well)As evident by the fact that his name gets dropped in nearly every one of my blogs, I am a huge admirer of Nate Silver. Particularly how he takes economics and statistics and applies them to areas typically outside the field. In the area of sports, Nate Silver has shifted forecasting away from betting lines and ESPN “analysts” and more towards a quantitative and probabilistic approach. I figured if Nate Silver can do it, I can get close.Basketball seemed like the easiest sport to start forecasting. Looking at the top records in the league shows that the best teams generally win 70%-80% of their games. Compare this to a sport like baseball where teams are more even and the best team only wins 63% of their games. So essentially, basketball has more skill involved and less randomness, more signal to capture and less noise.At my aid are my new-found skills in R and enrollment in ECON483 Economic Forecasting (I highly recommend taking this course). I spent the first few days of my Spring Break gathering data and crunching numbers. Looking for patterns between wins, points and general basketball statistics. I began to diverge into two types of basketball forecasting, macroforecasting and microforecasting. Macroforecasting pertains to season long play. How many wins will the team have? Where will they place in their conference? Which team will score the most points this season? Macroforecasting does this very well.

Former Sixers GM Sam Hinkie talks with a young Joel Embiid shortly after his drafting. Using Econometrics to Forecast Basketball Games (and doing well)As evident by the fact that his name gets dropped in nearly every one of my blogs, I am a huge admirer of Nate Silver. Particularly how he takes economics and statistics and applies them to areas typically outside the field. In the area of sports, Nate Silver has shifted forecasting away from betting lines and ESPN “analysts” and more towards a quantitative and probabilistic approach. I figured if Nate Silver can do it, I can get close.Basketball seemed like the easiest sport to start forecasting. Looking at the top records in the league shows that the best teams generally win 70%-80% of their games. Compare this to a sport like baseball where teams are more even and the best team only wins 63% of their games. So essentially, basketball has more skill involved and less randomness, more signal to capture and less noise.At my aid are my new-found skills in R and enrollment in ECON483 Economic Forecasting (I highly recommend taking this course). I spent the first few days of my Spring Break gathering data and crunching numbers. Looking for patterns between wins, points and general basketball statistics. I began to diverge into two types of basketball forecasting, macroforecasting and microforecasting. Macroforecasting pertains to season long play. How many wins will the team have? Where will they place in their conference? Which team will score the most points this season? Macroforecasting does this very well. For individual games, the macroforecasting approach was not effective. I realized this when I was explaining my research to a friend and he responded “Who cares?, I just want to know who wins tonight!” .For game-by-game forecasting I needed to explore the microforecasting approach. This approach looks at the scoring and defense of the two teams in a game and determines in outcome, this approach ends up being much more difficult.To model an individual game, be careful about what stats you use. Player stats are often measured in three different ways: per game, per 100 possessions, and per 36 minutes. It is important to focus on per game stats. Per possession and per minute stats are better on player specific statistics but on a whole team they are a poor measure. Remember, every team only control the pace when they are on offense. Stats like offensive efficiency and defensive efficiency can be skewed by fast or slow offenses in an actual game format.My microforecasting model continues to be refined but it looks something like this:The result of the game is Yv - Yh where Y is the predicted points for each team. If this number is positive, the visitor wins. If it is negative it is a home victory. Y is composed of:

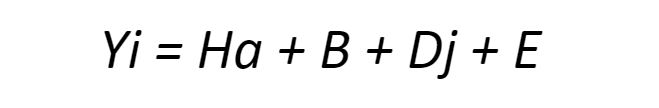

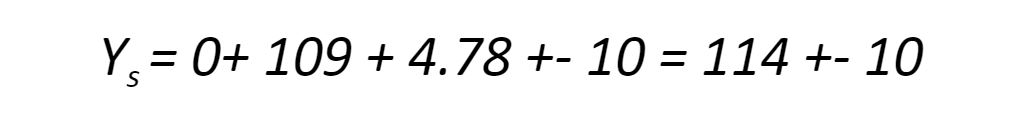

For individual games, the macroforecasting approach was not effective. I realized this when I was explaining my research to a friend and he responded “Who cares?, I just want to know who wins tonight!” .For game-by-game forecasting I needed to explore the microforecasting approach. This approach looks at the scoring and defense of the two teams in a game and determines in outcome, this approach ends up being much more difficult.To model an individual game, be careful about what stats you use. Player stats are often measured in three different ways: per game, per 100 possessions, and per 36 minutes. It is important to focus on per game stats. Per possession and per minute stats are better on player specific statistics but on a whole team they are a poor measure. Remember, every team only control the pace when they are on offense. Stats like offensive efficiency and defensive efficiency can be skewed by fast or slow offenses in an actual game format.My microforecasting model continues to be refined but it looks something like this:The result of the game is Yv - Yh where Y is the predicted points for each team. If this number is positive, the visitor wins. If it is negative it is a home victory. Y is composed of: Where y is the predicted points, Ha is a dummy (binary) variable that is activate for the home team because across 2056 games a clear home field advantage was observed, B is an adjusted average of points scored per game, Dj is the defense added points of the opposition (good defenses this number is negative because they take away and bad defenses have this as a positive number. This number can also be influenced by how fast the opposing team’s offense runs.), and E is an error term. Numbers get rounded down to whole numbers because you cannot score half points in basketball. My actual running model is of course more complicated than this, but this equation accounts for most of it.As an example, let's use the Friday March 30th, 2018 7:30PM game with the Philadelphia 76ers facing off against the Atlanta Hawks. The Sixers forecasted score is:

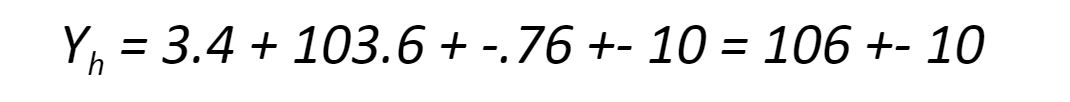

Where y is the predicted points, Ha is a dummy (binary) variable that is activate for the home team because across 2056 games a clear home field advantage was observed, B is an adjusted average of points scored per game, Dj is the defense added points of the opposition (good defenses this number is negative because they take away and bad defenses have this as a positive number. This number can also be influenced by how fast the opposing team’s offense runs.), and E is an error term. Numbers get rounded down to whole numbers because you cannot score half points in basketball. My actual running model is of course more complicated than this, but this equation accounts for most of it.As an example, let's use the Friday March 30th, 2018 7:30PM game with the Philadelphia 76ers facing off against the Atlanta Hawks. The Sixers forecasted score is: For the Hawks it is:

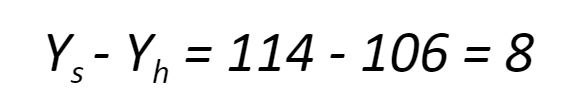

For the Hawks it is: Thus, the forecasted result is:

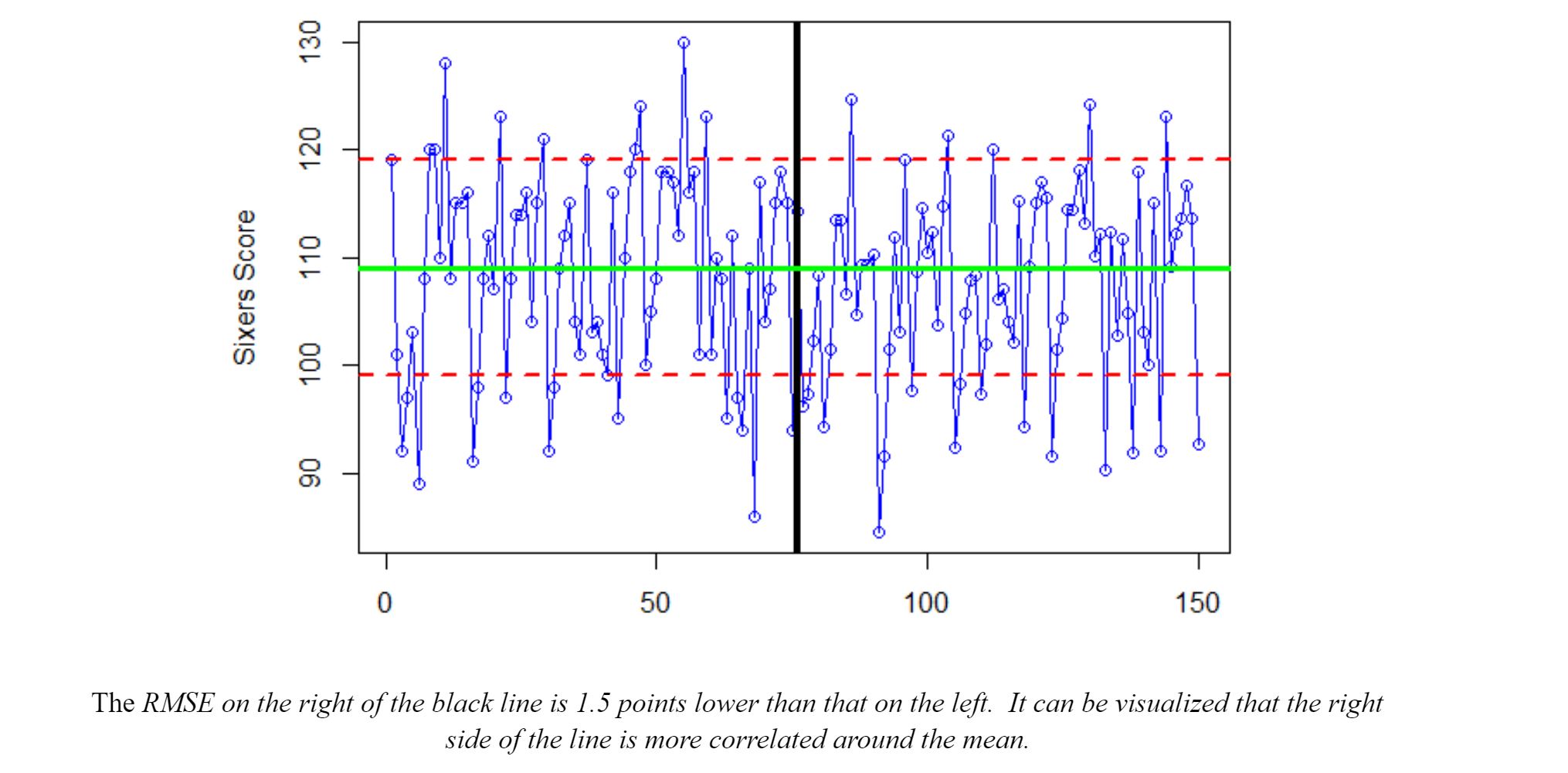

Thus, the forecasted result is: The model forecasts a Sixers, the visiting team, victory by plus 8. The actual game was much lower scoring than anticipated, particularly because the Sixers played their worst players in the 4th quarter to rest the starters for the playoffs, and the final score was 101-91. The Sixers won by 10 and the residual between the forecast and the actual score is -2. Although not perfect, sports are volatile and getting this close is impressive.To run this regression in programs like STATA and R, treat opposing defenses like seasonality. This will treat the opposing defenses like dummy variables and apply them when the team name is equal to a certain character value. To visualize the effect of opponent defense on score look at the plot below. It is the 76ers scores for each game plotted twice, to the left of the black line for unadjusted and to the right for adjusted. The red dashed lines are at 119 and 99 (within one standard deviation) and the green line is the Sixer’s B of 109. Although slightly, the right side of the black line is more correlated around the mean.

The model forecasts a Sixers, the visiting team, victory by plus 8. The actual game was much lower scoring than anticipated, particularly because the Sixers played their worst players in the 4th quarter to rest the starters for the playoffs, and the final score was 101-91. The Sixers won by 10 and the residual between the forecast and the actual score is -2. Although not perfect, sports are volatile and getting this close is impressive.To run this regression in programs like STATA and R, treat opposing defenses like seasonality. This will treat the opposing defenses like dummy variables and apply them when the team name is equal to a certain character value. To visualize the effect of opponent defense on score look at the plot below. It is the 76ers scores for each game plotted twice, to the left of the black line for unadjusted and to the right for adjusted. The red dashed lines are at 119 and 99 (within one standard deviation) and the green line is the Sixer’s B of 109. Although slightly, the right side of the black line is more correlated around the mean. As a sports fan, using the stat and game theory skills I picked up in the classroom through the B.S. in Economics allows me to get involved with the game. I have become a more informed fan, despite only watching half of my home team’s games. I encourage anyone to apply statistics to an interest of theirs, it is surprisingly fun and gives new insights into that field._______ Author's Note: All statistical data comes from basketballreference.com All analysis and graphing was done using R within Rstudio or Microsoft Excel. For more information contact optimalbundle.psuea@psu.edu. Editor's Note: Minor changes have been made to the original version of this piece. Feature Image Credit: Public Domain

As a sports fan, using the stat and game theory skills I picked up in the classroom through the B.S. in Economics allows me to get involved with the game. I have become a more informed fan, despite only watching half of my home team’s games. I encourage anyone to apply statistics to an interest of theirs, it is surprisingly fun and gives new insights into that field._______ Author's Note: All statistical data comes from basketballreference.com All analysis and graphing was done using R within Rstudio or Microsoft Excel. For more information contact optimalbundle.psuea@psu.edu. Editor's Note: Minor changes have been made to the original version of this piece. Feature Image Credit: Public Domain

PinnacleHealth already searching for capital, immediately shifted its focus to its next potential partner. In 2017 PinnacleHealth successfully merged with UPMC, further consolidating Pennsylvania’s largest health system. As predicted, the newly created UPMCPinnalce expanded quickly, operating 12 hospitals in ten counties across central Pennsylvania.

PinnacleHealth already searching for capital, immediately shifted its focus to its next potential partner. In 2017 PinnacleHealth successfully merged with UPMC, further consolidating Pennsylvania’s largest health system. As predicted, the newly created UPMCPinnalce expanded quickly, operating 12 hospitals in ten counties across central Pennsylvania.

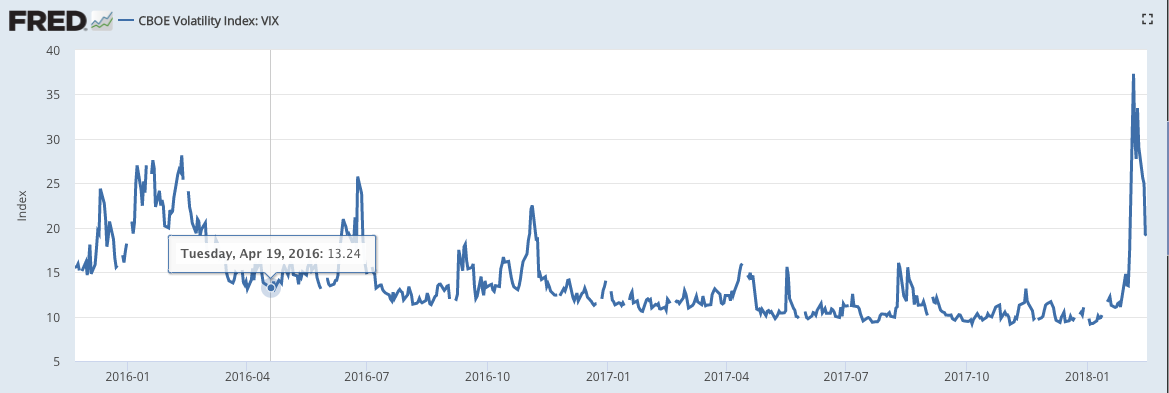

The value of the VIX was steady at

The value of the VIX was steady at  Over the last year the price of the XIV was rising fast to a level over 100 until it crashed. In about two weeks the XIV lost 100% of it’s value and is no longer available for purchase.At the same time the price of the VIX rose to levels not seen since the 2008 financial crisis.Hopefully that all made sense but there’s one more wrench that was thrown into the equation. A whistleblower told

Over the last year the price of the XIV was rising fast to a level over 100 until it crashed. In about two weeks the XIV lost 100% of it’s value and is no longer available for purchase.At the same time the price of the VIX rose to levels not seen since the 2008 financial crisis.Hopefully that all made sense but there’s one more wrench that was thrown into the equation. A whistleblower told